SME Launches Training and EV Certification Program

NEWS

SME has developed an electric vehicle training and certification program. Photo courtesy SME

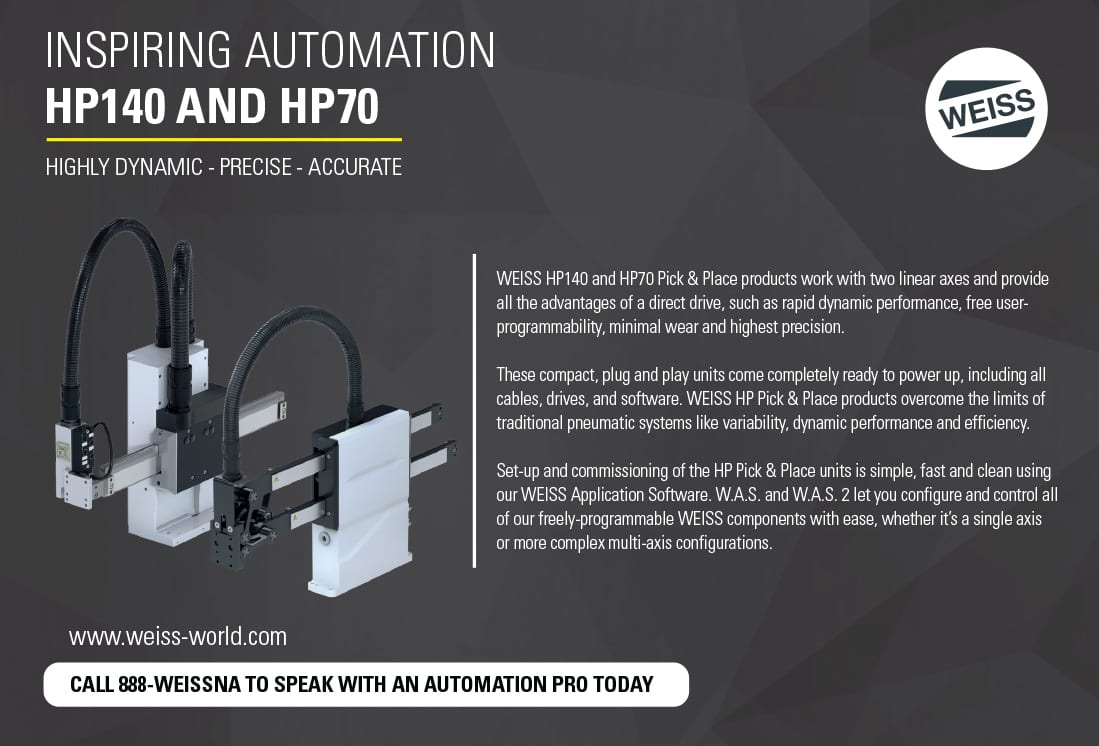

SOUTHFIELD, MI—As the auto industry transition to electrification accelerates, the need for workers with EV-related skillsets is increasingly critical. To address the issue, SME has developed an Electric Vehicle Fundamental certification to help the thousands of new jobs that relate to the production and maintenance of electric cars.

SME obtained input from industrial and academic experts to develop a Body of Knowledge that encompasses the technologies, job roles, competencies, and skills critical to the electrification industry. The training roadmap takes learners through broader manufacturing areas that are foundational to automotive assembly, electric vehicle production, and e-mobility manufacturing.

In addition, electrification-specific training is designed to incorporate key learning objectives to prepare learners whether individuals have no background in vehicle production and assembly, or they have experience but need to tailor their knowledge to the EV market. Topics like lithium battery handling and safety, high-energy batteries, and electric vehicle components and manufacturing are covered in-depth.

The training, along with the certification, prepares individuals to thrive in a variety of job roles, including assembly technician, production associate, team assembler, manufacturing technician, battery pack assembler, quality control inspector, electric motor assembler, and maintenance technician.

SME's efforts to upskill workers for electric vehicle manufacturing include support from industry groups and states; especially those with heavy concentrations of automotive companies.

“To ensure all of North America’s talent has the capabilities needed to adopt new technologies and advance manufacturing, SME has undertaken extensive research into labor demands for EV manufacturing and electrification, including leveraging insights from industry leaders,” said Jeannine Kunz, SME’s chief workforce development officer. “Our collaboration with manufacturers, schools, and workforce organizations will embed in-demand EV expertise and competencies into nationwide career development programs and technical education.”

“WithEVtechnologyrevolutionizingtheautomotiveindustry,thereisauniqueopportunityfor thousands of individuals to harness its potential into a promising career,” said Robert “Bob” Willig, executive director and CEO of SME. “SME’s strong partnerships with industry and education, commitment to advancing emerging technologies, focus on upskilling the nation’s workforce and dedication to validating competency through certification will all contribute to supporting the evolution of U.S. manufacturing in this way.”

SME is committed to supporting the industry's transition to battery electric vehicles and will remain dedicated to closely evaluating the evolving needs of the industrial and educational spheres. As a nonprofit whose purpose is to advance manufacturing to drive competitiveness, resiliency and national security, SME will actively identify upcoming challenges and opportunities to position North America at the forefront of electric vehicle design and production.

Factorial Opens Solid-State Battery Plant in Massachusetts

A new factory north of Boston will produce solid-state batteries for electric vehicles. Photo courtesy Factorial Inc.

METHUEN, MA—Factorial Inc. has opened a new $50 million facility here to produce solid-state batteries for electric vehicles. It plans to scale up production with a 200-mega-watt-hour assembly line. The company’s FEST (Factorial Electrolyte System Technology) quasi-solid-state batteries are designed for higher energy density and safety compared to traditional lithium-ion batteries.

“We are thrilled to open our next-generation battery facility in Massachusetts as we scale our batteries for mass production,” says Siyu Huang, CEO of Factorial. “This facility will enable us to manufacture cells to meet the needs of our automotive partners and progress our mission to commercialize solid-state batteries. As a U.S. company, we’re also proud to contribute to the onshoring of battery manufacturing for EVs and advancement of battery innovation for a differentiated supply chain.”

“[We continue] to drive the battery industry forward and this milestone is no exception,” adds Joe Taylor, executive chairman of Factorial. “Automaker demand for American-made batteries is high to produce electric or hybrid vehicles that qualify for incentives. Our facility will manufacture automotive-sized solid-state batteries at preproduction speed and volume, illuminating a clear path to mass production and reaching economies of scale.”

EVBox Starts Assembling DC Fast-Charging Stations in Illinois

EVBox is assembling fast-chargers at a new factory near Chicago. Photo courtesy EVBox

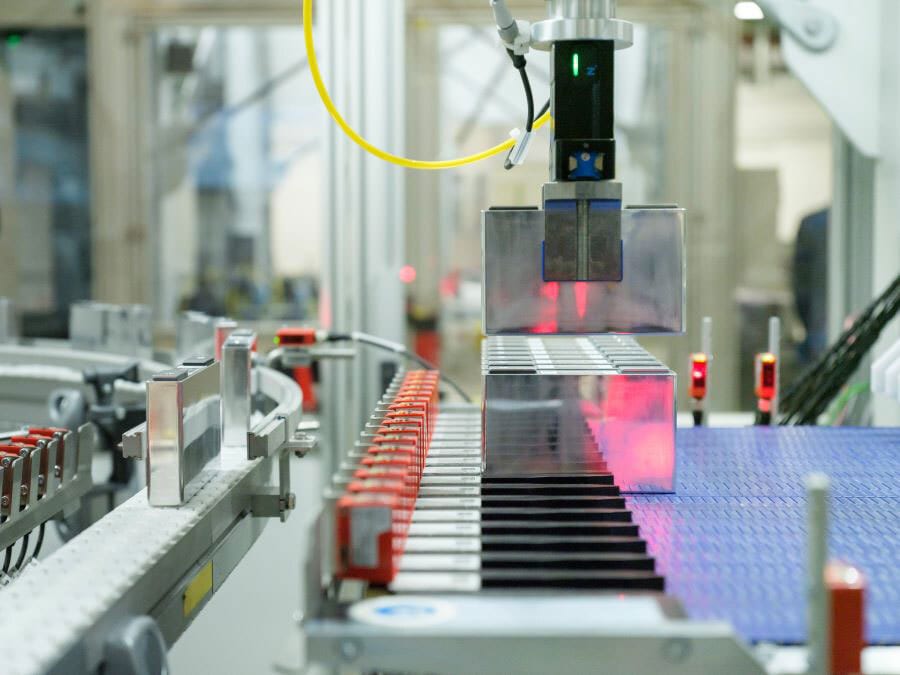

LIBERTYVILLE, IL—EVBox has started assembling charging stations at its new 50,000-square-foot factory here. The Troniq Modular features upgradeable power modules that enable output ranging from 90 to 240 kilowatts (kW) in 30 kW increments. The DC fast-charging units are designed to scale as demand for EV chargers expands.

Dynamic load balancing technology allows multiple vehicles to charge simultaneously, reducing dwell and wait times at charging locations even as EV adoption grows exponentially. A multilingual touchscreen and intuitive status LED indicator lights provide motorists with a swift, hassle-free charging session.

EVBox's new DC fast charger is compliant with the U.S. Infrastructure Investment and Jobs Act's Build America, Buy America guidelines, which requires that chargers be produced in the United States with at least 55 percent domestic content.

"As we look to the future of EV travel in America, we envision a charging station network that seamlessly connects cities and regions," says Remco Samules, CEO of EVBox. "The electrification of transportation will reduce our carbon footprint and lead to cleaner air, improved health, and a more sustainable future for generations to come. Through public-private partnerships like the one we have with Illinois, we are setting the stage for this transition."

"I'm proud to work closely with industry partners like EVBox to advance our shared clean energy goals and accelerate the transition to zero-emission vehicles," adds Illinois Governor J.B. Pritzker. "Major EV, EV parts and renewable energy manufacturers have chosen to locate or expand operations in Illinois thanks to our competitive incentives, unmatched infrastructure, world-class workforce and commitment to the clean energy economy."

Future Battery Cell Factories May Consume Less Amounts of Electricity

Battery cell factories will consume less amounts of electricity in the future. Photo courtesy BMW AG

MUNSTER, Germany—Current battery cell manufacturing processes are energy intensive and produce high levels of greenhouse gas emissions. However, new product and production technologies will be able to optimize production to achieve large savings in the future.

The electricity demand of all battery factories planned to be in operation worldwide in 2040 will be 130,000 gigawatt-hours (GWh) per year, which is equivalent to the current electricity consumption of Norway or Sweden. That’s the finding of a recent study conducted by the Fraunhofer Research Institution for Battery Cell Production (FFB) and the University of Münster.

“Not only in Europe, but also in Asia and North America, the construction of battery cell factories is being promoted in order to drive the necessary change in mobility,” says Florian Degen, Ph.D., director of strategy and corporate development at Fraunhofer FFB. “With today's know-how and production technology, it takes 20 to 40 kilowatt-hours of energy to produce a battery cell with a storage capacity of 1 kilowatt-hour, depending on the type of battery produced and even without considering the material.”

According to Degen, technological improvements in production, such as the use of heat pumps, alternative drying technologies and new drying room concepts, as well as learning and economies of scale, will save up to 66 percent of energy by 2040. These potential savings are equivalent to the electricity consumption of Belgium or Finland in 2021.

In addition, Degen says the production of alternative battery technologies, such as solid-state batteries, will require significantly less energy per unit of battery storage capacity produced than the production of current lithium-ion batteries.

Consumers Are Souring on Autonomous Vehicles

Consumer confidence in fully automated, self-driving vehicles has declined. Illustration courtesy Bosch

TROY, MI—Consumer confidence in fully automated, self-driving vehicles has declined for a second consecutive year, according to the latest J.D. Power U.S. Mobility Confidence Index (MCI) Study, which was conducted in collaboration with the Advanced Vehicle Technology (AVT) Consortium at the Massachusetts Institute of Technology (MIT).

People were asked a series of questions about their readiness for AV technology in several categories, including personal vehicles; commercial vehicles; public transit; riding if unable to drive due to age or injury; and sharing the road with other AVs.

Consumers show low readiness on all metrics, with the lowest level of comfort riding in a fully automated vehicle and using self-driving public transit. Despite lots of hype, public opinion and consumer comfort have been eroded by a lack of general knowledge about AV technology development, in addition to media coverage that highlights robotaxi incidents and testing failures.

Confidence soars, however, for consumers who have ridden in an AV, with an MCI index score of 67, which is almost double the index score (37) of those who haven’t had the experience. Not surprisingly, consumer comfort is higher in the West, where a majority of testing is occurring in states such as Arizona and California.

“Consumer trust is fragile, but it is the foundation upon which long-term AV acceptance is built,” says Lisa Boor, senior manager of auto benchmarking and mobility development at J.D. Power. “This first-time feedback from robotaxi riders shows significant growth in consumer comfort levels across any AV application.

“Industry stakeholders must seize the opportunity to build confidence and promote the technology across all transportation modalities through these first-hand experiences,” claims Boor. “But, for success, it cannot be overshadowed by endless deployment issues.”

“Experience with automation appears to greatly improve confidence in the technology,” adds Bryan Reimer, Ph.D., founder of MIT’s AVT Consortium. “As trust is built over time but eroded quickly, stakeholders may need to find new ways to proactively educate potential users on the advantages and current limitations of vehicle automation systems.

“Automated driving technology is still very much in an evolving and testing stage, with improvements occurring quickly,” explains Reimer. “Consumers’ understanding of where we are on the path to long-term automated mobility needs to be calibrated, as today’s systems are not designed to enable more risky driving.”

Lithium-Ion Battery Improvements Will Drive Big Increase in Production

Global EV battery production will increase dramatically by the end of this decade. Photo courtesy Skoda Auto

NEW YORK—Achieving ambitious EV adoption targets will require massive growth in battery manufacturing and raw material supply chains, claims a new report by ABI Research. However, despite current challenges, global production should increase dramatically by the end of this decade.

“Battery cost and production volume are the key barriers to adoption for EVs,” says Dylan Khoo, electric vehicles industry analyst at ABI Research. “The most important technologies are, therefore, those that make batteries cheaper or easier to manufacture at scale.

“Revolutionary technologies, such as solid-state batteries, promise improved ranges and reduced charging times, generating much media attention, but are too expensive and difficult to manufacture,” notes Khoo. “Battery developments this decade will focus on evolutionary improvements on current lithium-ion batteries.”

According to Khoo, the EV battery boom will put pressure on suppliers of raw materials. From 2022 to 2030, there will be a 5.3-fold increase in demand for lithium and a 3.2-fold increase in demand for cobalt for batteries. “Reducing the consumption of these critical minerals is an essential goal for battery manufacturers, particularly cobalt, due to its volatile supply and unethical practices involved in its mining,” he explains.

Khoo predicts that the average cobalt content of EV batteries will decrease 44 percent by 2030. Improved pack assembly techniques, such as cell-to-pack (C2P) technology, will increase the overall energy density of cobalt-free lithium iron phosphate (LFP), allowing them to be used in more applications. Cobalt content can also be reduced by increasing overall energy density with high-nickel nickel manganese cobalt (NMC) cathodes.

“There are EVs with long ranges and EVs that can charge quickly, but there are no EVs that cost the same as their fossil fuel counterparts,” says Khoo. “Evolutionary improvements over current lithium-ion battery technology will be essential to reduce the cost of EVs and achieve industrywide electrification targets.

“Solid-state batteries are unlikely to significantly impact this decade, because their adoption would require changes in cell design and manufacturing, unlike improvements on existing lithium-ion battery technology,” adds Khoo.

DECEMBER 2023 | ASSEMBLYMAG.com