General Motors has an ambitious electric vehicle strategy that includes new products, new plants and new production processes. The 113-year-old automaker plans to invest $27 billion in EVs through 2025.

That’s a 35 percent increase over what it previously announced one year ago. With the unprecedented initiative, the company hopes to corner a lucrative share of the EV market and thwart efforts from competitors such as Tesla and Volkswagen.

GM is currently investing billions of dollars to upgrade several assembly plants that will mass-produce a wide variety of EVs during this decade. Its goal is to sell 1 million EVs worldwide by 2025. Today, traditional internal combustion engine vehicles account for 98 percent of the company’s global sales.

Within five years, GM expects to offer 30 all-electric models globally. And, 40 percent of its U.S. offerings will be EVs by the end of 2025.

“Buick, Cadillac, Chevrolet and GMC will all be represented with EVs at all price points for work, adventure, performance and family use,” says Mary Barra, CEO of GM. “Climate change is real, and we want to be part of the solution by putting everyone in an electric vehicle.

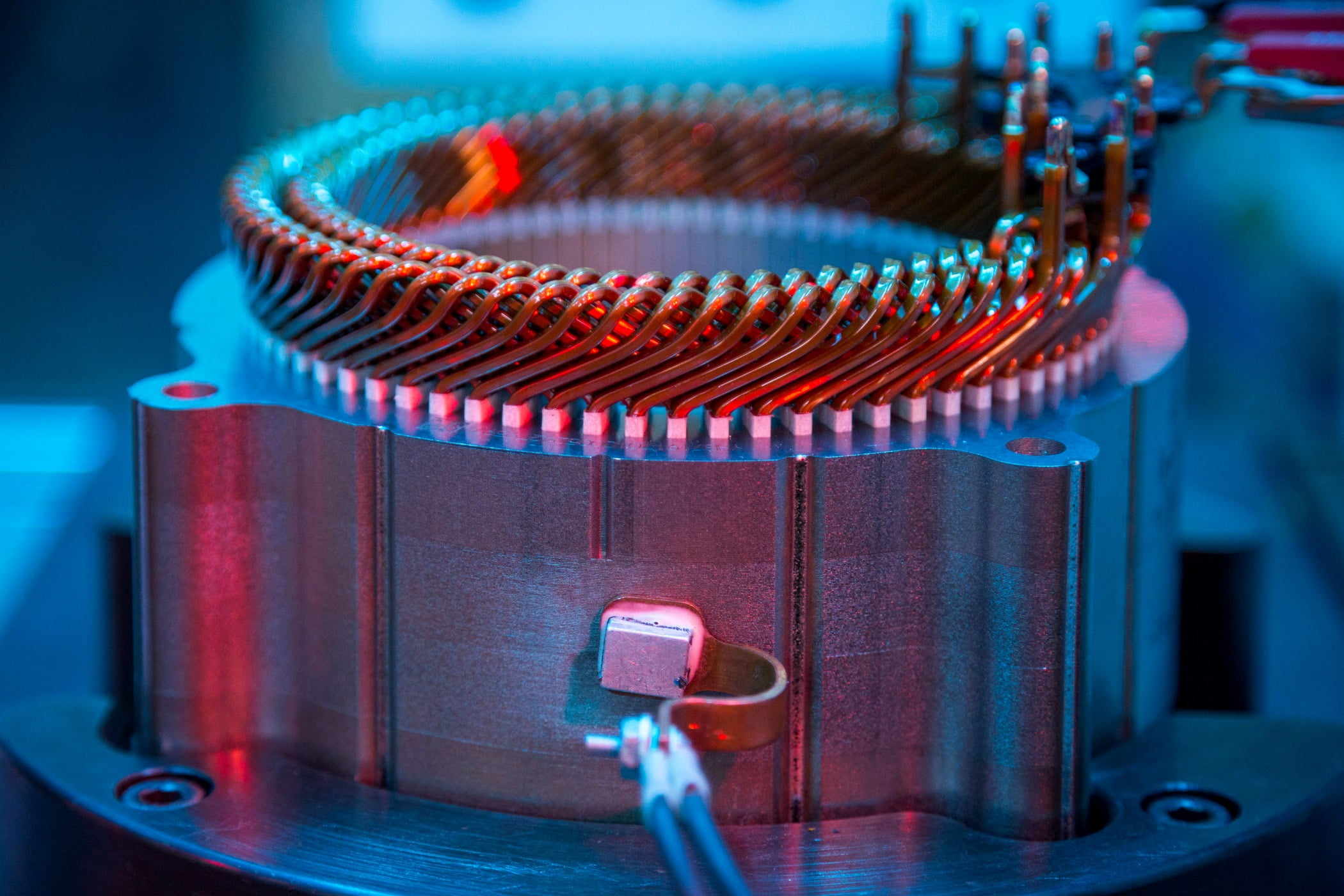

GM’s next-generation EVs will be powered by a family of interchangeable drive units and motors. Photo courtesy General Motors

By Austin Weber, Senior Editor

Inside GM’s Big, Bold Bet on Batteries

New products, plants and production processes are behind an ambitious EV initiative.

“We are transitioning to an all-electric portfolio from a position of strength and we’re focused on growth,” claims Barra. “We can accelerate our EV plans because we are rapidly building a competitive advantage in batteries, software, vehicle integration, manufacturing and customer experience. We are resolved as a management team to move even faster to expedite the transition to EVs.”

To address that goal, GM recently launched a hiring spree to add 3,000 new employees across engineering, design and IT functions. The company is also in the process of hiring more than 1,000 people to staff its new battery plant in Lordstown, OH.

Borrowing an idea from Tesla, GM’s initial product offerings based on its Ultium battery architecture will be luxury vehicles aimed at high-end buyers. It plans to sell a small number of expensive models first, followed by lower-priced versions later.

Late this year, GM’s first next-generation EV will roll off the line at the company’s 36-year-old Hamtramck plant in Detroit. However, it won’t be a small car. Instead, GM is resurrecting the Hummer nameplate—once synonymous with being a gas-guzzler—under its GMC brand. The much-anticipated Hummer EV pickup truck will feature a 24-module battery pack and a three-motor drive system, in addition to a four-wheel steering system.

The Hummer EV will be followed by the Lyriq, Cadillac’s first all-electric vehicle, which will be assembled in Spring Hill, TN. Other vehicles joining them in GM’s expanding EV lineup will include a Buick crossover, a Chevy pickup truck, a midsized Chevy sport utility vehicle and a GMC Hummer SUV.

GM is investing $27 billion over the next five years to develop advanced battery technology and electric vehicles. Photo courtesy General Motors

Better Batteries

The heart of GM’s strategy is a modular propulsion system and a highly flexible global EV platform powered by proprietary Ultium batteries. Ultium’s state-of-the-art NCMA (nickel-cobalt-manganese-aluminum) chemistry uses aluminum in the cathode to help reduce the need for controversial rare-earth materials such as cobalt.

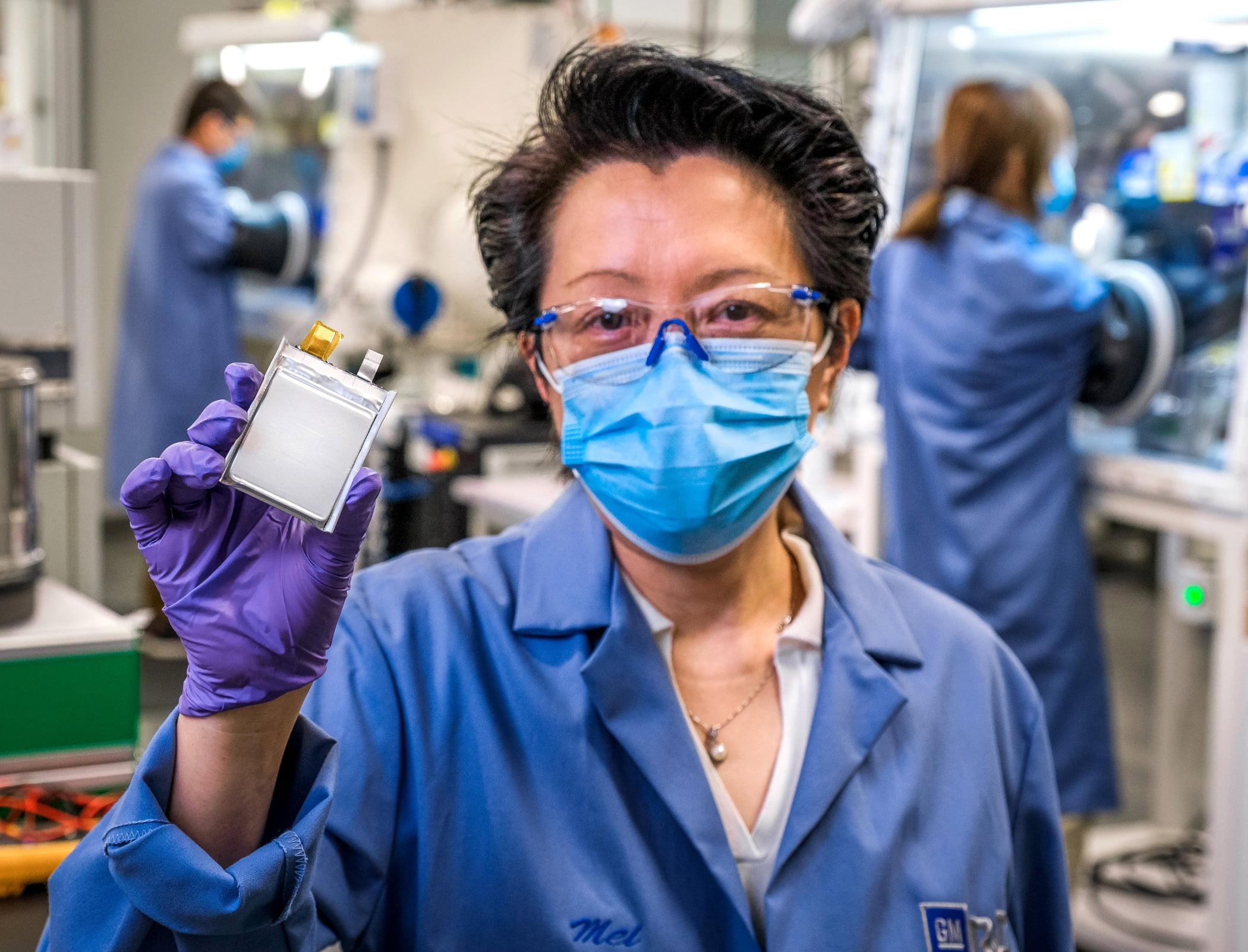

The advanced battery chemistry is packed in large, flat pouch cells that enable smart module construction to reduce complexity and simplify cooling needs. Each cell includes a stack of planar electrodes that are immersed in a polymer electrolyte and wrapped in an aluminum pouch. Additionally, the battery electronics are incorporated directly into the modules, eliminating nearly 90 percent of the battery pack wiring compared to GM’s current electric vehicles.

The Ultium cells were developed in partnership with LG Chem and they will be produced near a former GM assembly plant in Lordstown, OH, that closed in 2019. The new 3-million-square-foot facility will have annual capacity of more than 30 gigawatt hours and room for expansion. Ultium Cells LLC plans to mass-produce up to 250 million cells a year by 2025.

GM is doing most of the development work on these cells in-house at its Chemical and Materials Systems Lab located at the Global Technical Center in Warren, MI. The facility features a fabrication line with polymer mixing, slurries, a coating machine and a cell assembly room. This year, GM plans to begin building a new Battery Innovation Lab and Manufacturing Technology Center to develop the next-generation of Ultium batteries.

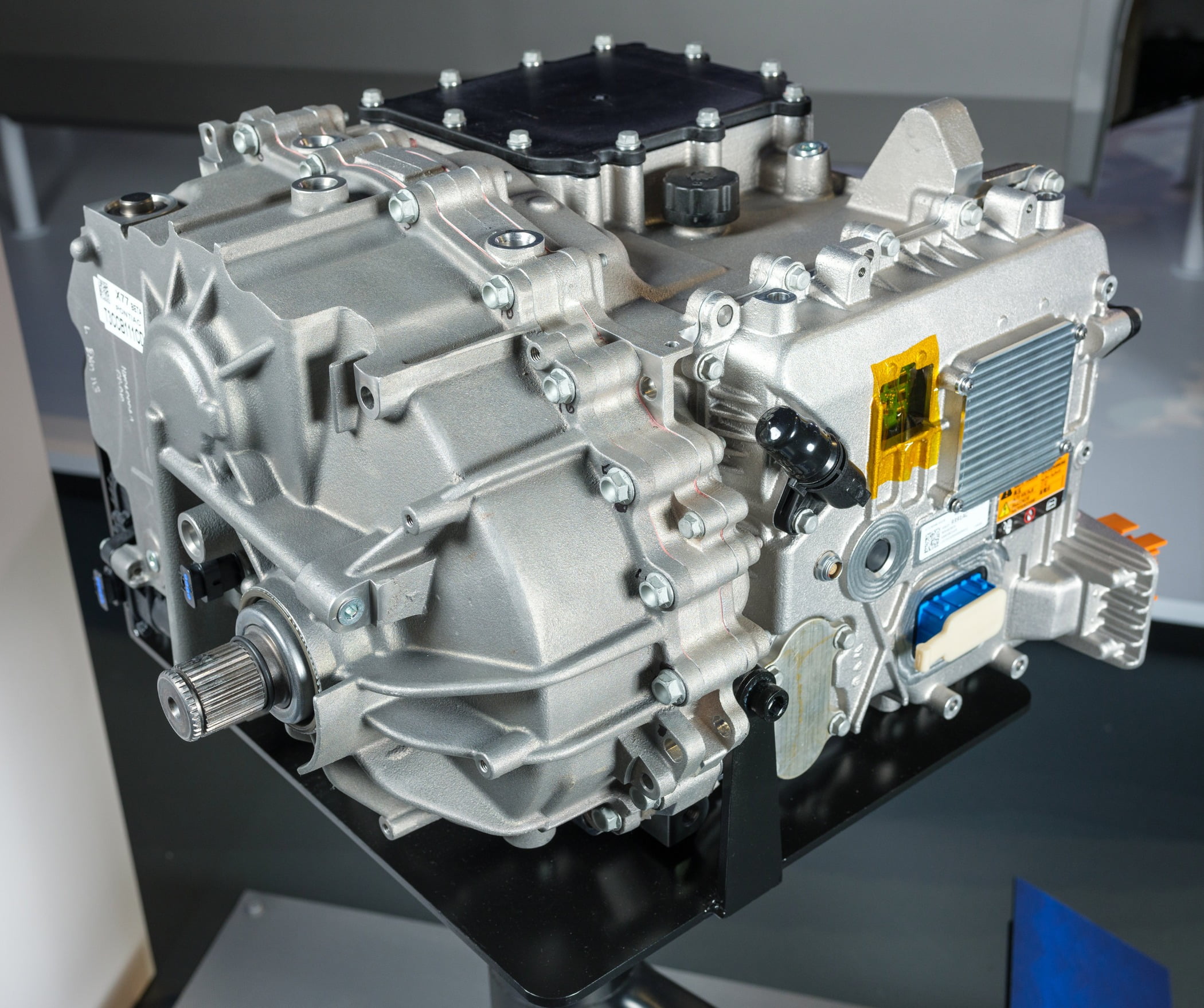

General Motors’ electric vehicle strategy depends on Ultium platforms that use in-house built batteries and drive train components. Photo courtesy General Motors

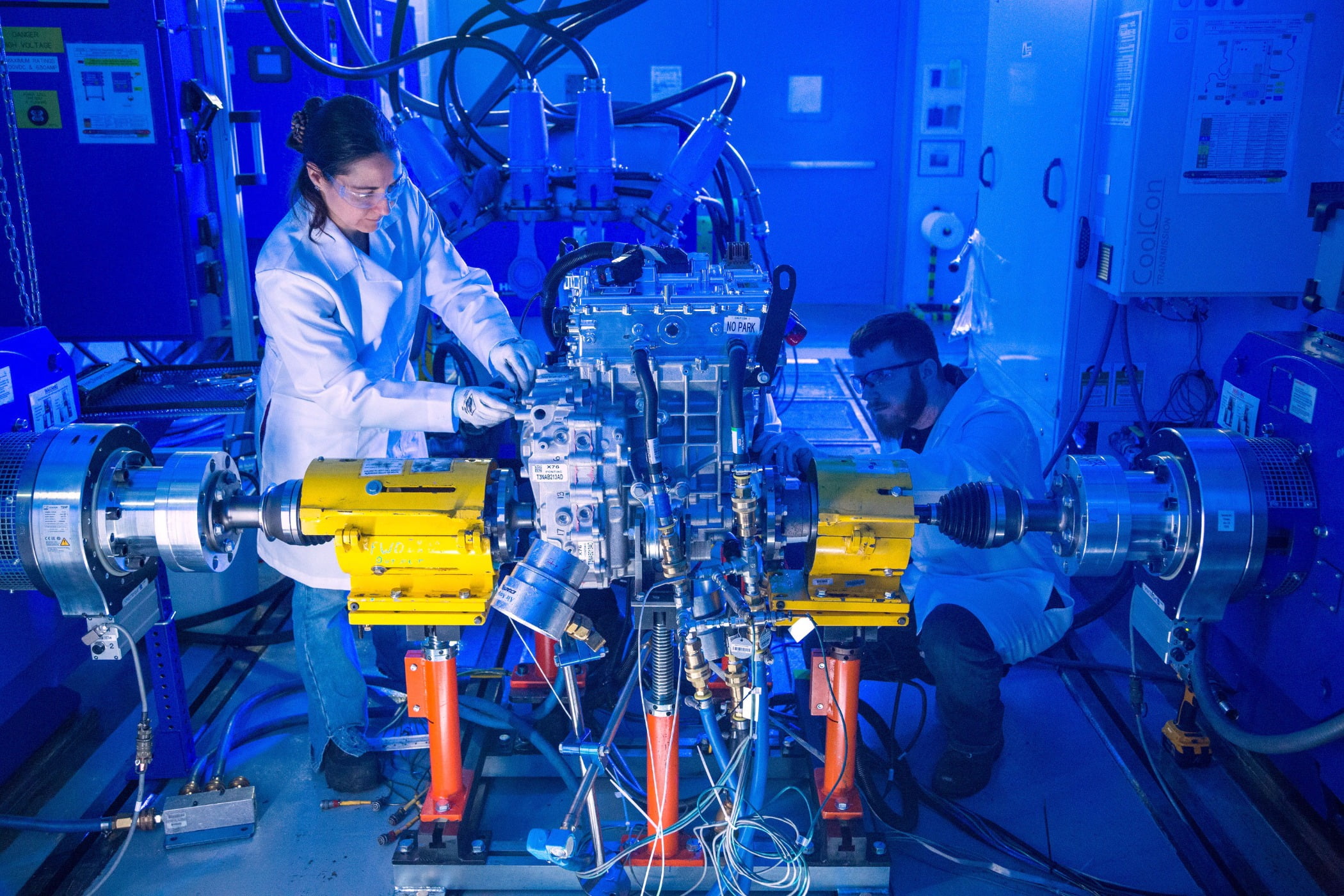

“Despite the coronavirus pandemic, [our] work on EVs accelerated during 2020,” says Doug Parks, executive vice president of global product development, purchasing and supply chain. “Ultium already represents a milestone achievement in electrification, with battery pack costs nearly 40 percent lower than those in the Chevrolet Bolt EV.

“Now, [we are] projecting that second-generation Ultium packs, expected mid-decade, will cost 60 percent less than the batteries in use today with twice the energy density expected,” Parks points out.

According to Parks, these second-generation cells will get closer to cost parity with gas-powered engines due to:

• Cell design that enables higher energy density and uses less non-active material, making more room for the part of the battery that produces energy.

• Manufacturing efficiencies through GM’s joint venture with LG Chem.

• Better integration between vehicles and their battery packs, enabling fewer cells and modules.

• Less expensive cathodes, reduced active material, novel electrolytes and the first use of lithium metal anodes in a GM battery.

The first two vehicles featuring GM’s Ultium battery architecture will be the Hummer EV pickup truck (left) and the Cadillac Lyriq crossover (right). Photos courtesy General Motors

“[We have] completed hundreds of test cycles on the multilayer prototypes of this next-generation Ultium cell chemistry,” explains Parks. “Production cells are expected by mid-decade.

“The Ultium platform is flexible enough to accept new chemistry and even cell types, without redesigns to its architecture,” claims Parks. “Ultium batteries will be easy to service at the module level, which makes repair costs less expensive than having to replace the whole pack.

“[Our] EV development times are speeding up and costs are going down rapidly, so we expect our Ultium programs to be profitable from the first generation on,” says Parks. “It’s not just the cost and performance of our innovative EV components that will give us a competitive advantage in a fast-changing industry, but how we integrate them with other advanced systems like Super Cruise, our vehicle intelligence platform electrical architecture.”

In-House Built Components

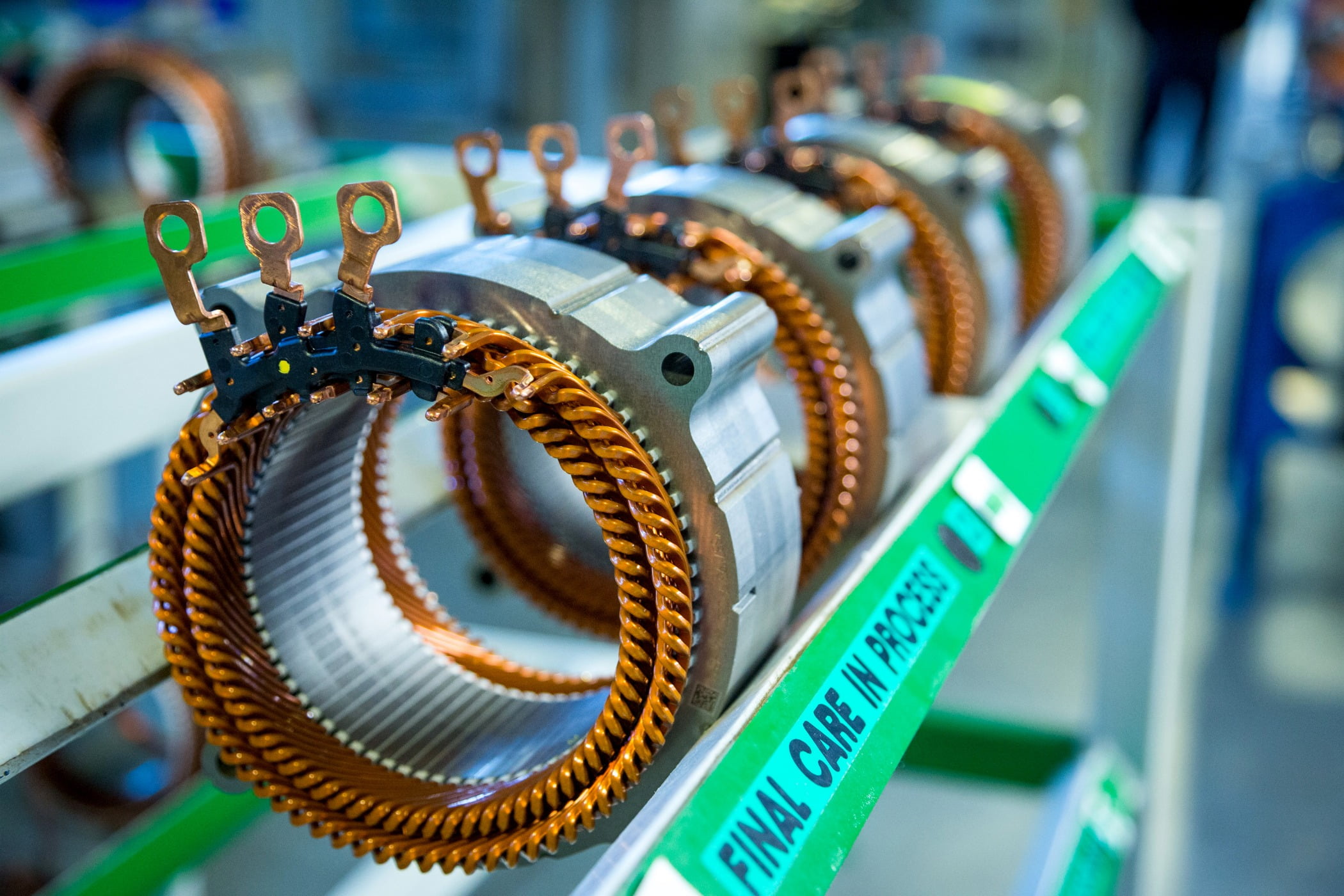

GM’s next-generation EVs will be powered by a family of five interchangeable drive units and three motors, known collectively as Ultium Drive.

“Ultium Drive will help [us] transition [our] current portfolio to a fully electric lineup, providing significant advantages over [our] previous EVs in performance, scale, speed to market and manufacturing efficiencies,” claims Ken Morris, vice president of autonomous and electric vehicle programs at GM.

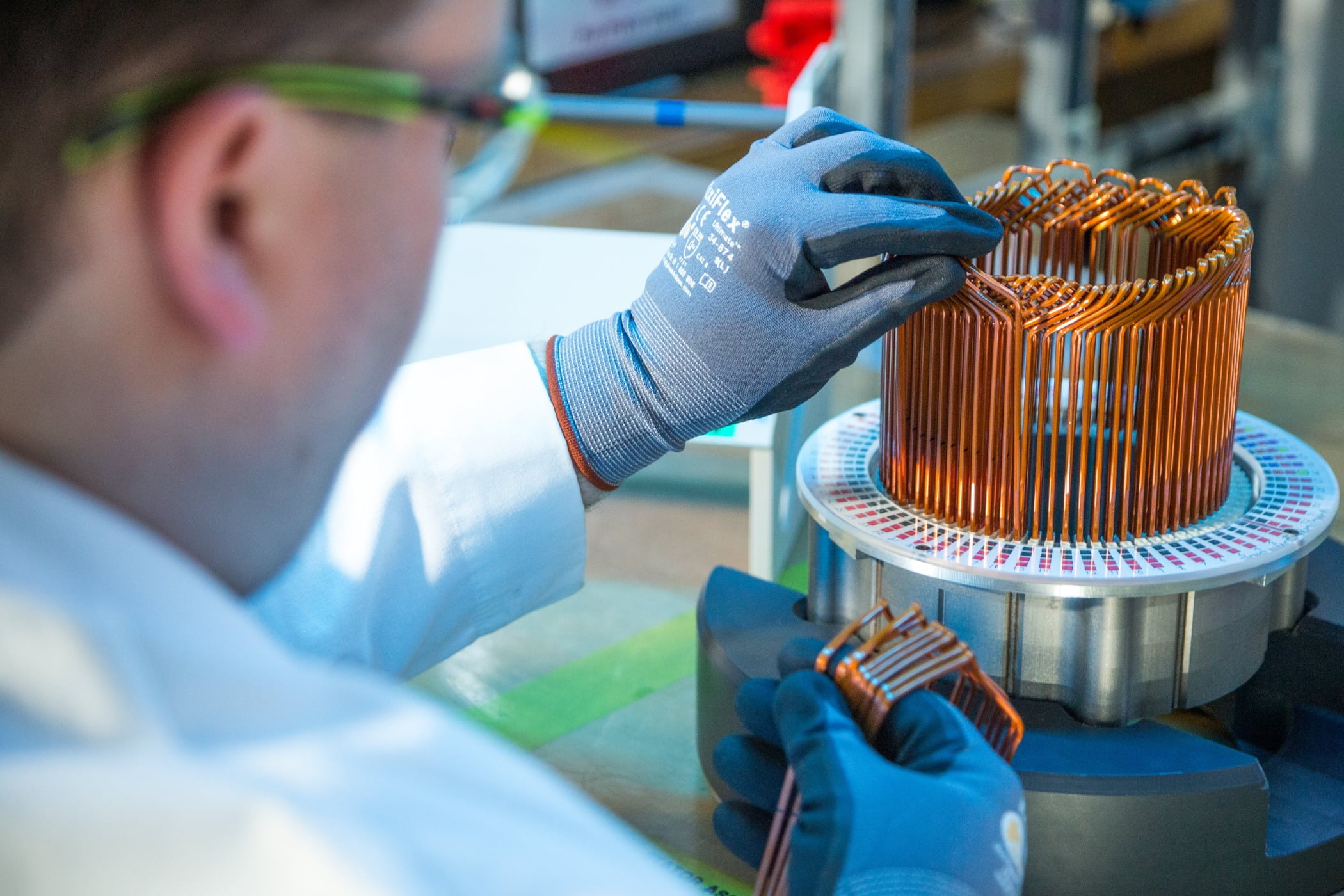

GM engineers are developing next-generation battery packs that will cost 60 percent less than the batteries in use today with twice the energy density. Photo courtesy General Motors

Ultium Drive features a modular architecture of electric motors and single-speed transmissions. According to Morris, they will provide “industry-leading torque and power density across a wide spectrum of different vehicle types. Ultium Drive will be more responsive than its internal combustion equivalents with precision torque control of its motors for smooth performance.

“Making motors, transmissions, driveline components and systems are among GM’s best-known competencies, and our manufacturing expertise is proving not only transferable but advantageous as we make the transition to EVs,” explains Morris.

“[We] applied 25 years of EV experience to Ultium Drive with lighter and more efficient designs that feature clever integration,” adds Morris. “For example, by integrating the power electronics into the drive units’ assemblies, the mass of the power electronics has been reduced by nearly 50 percent from [our] previous EV generation, saving cost and packaging space while increasing capability by 25 percent.

“This consolidation of parts and features also makes it easier to scale Ultium Drive across [our] future EV lineup,” Morris points out. “The power and versatility of these drive units will help [us] migrate high-output segments like pickup trucks and performance vehicles to all-electric propulsion, while providing the bandwidth to propel [our] EV portfolio well into the future.”

The Ultium Drive family covers front-wheel drive, rear-wheel drive and all-wheel drive propulsion combinations, including high-performance and off-road capabilities.

GM’s Ultium battery chemistry is packed in flat pouch cells that enable smart module construction to reduce complexity and simplify cooling needs. Photo courtesy General Motors

Most Ultium Drive components, including castings, gears and assemblies, will be built on shared, flexible assembly lines. Photo courtesy General Motors

All five drive units will be powered by one or more of three motors, including a primary front-wheel drive motor that can be configured for front- or rear-wheel drive, and an all-wheel drive assist motor.

“As with other propulsion systems that are complex, capital intensive and contain a great deal of intellectual property, we’re always better off making them ourselves,” says Adam Kwiatkowski, executive chief engineer for global electrical propulsion at GM. “[Our] full lineup of EVs should benefit from the simultaneous engineering of Ultium Drive. Our commitment to increased vertical integration is expected to bring additional cost efficiency to the performance equation.

“Most of the Ultium Drive components, including castings, gears and assemblies, will be built with globally sourced parts at [our] existing global propulsion facilities on shared, flexible assembly lines,” explains Kwiatkowski. “[This will allow us] to more quickly ramp up EV production, achieve economies of scale and adjust [our] production mix to match market demand.”

GM also plans to become the first automaker to use an almost completely wireless battery management system (wBMS). The system, developed with Analog Devices Inc., will enable GM to power many different types of electric vehicles from a common set of battery components.

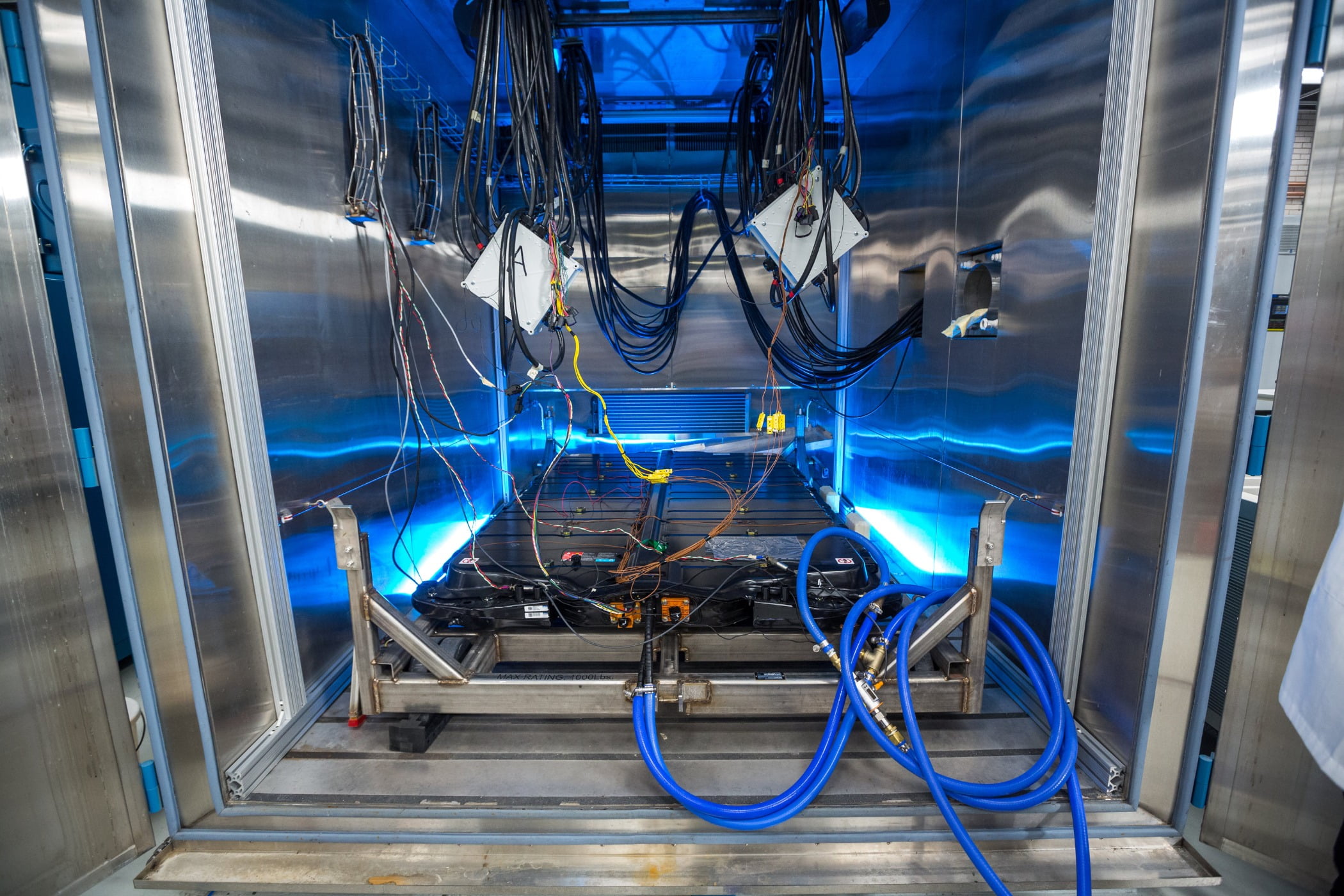

Despite the coronavirus pandemic, GM’s engineers accelerated their work on electric vehicle technology during 2020. Photo courtesy General Motors

“The wBMS [will drive our] EVs to market faster, as time won’t be needed to develop specific communication systems or redesign complex wiring schemes for each new vehicle,” says Kent Helfrich, executive director of global electrification and battery systems at GM. “Instead, the wBMS helps to ensure the scalability of Ultium batteries across [our] future lineup, encompassing different brands and vehicle segments, from heavy-duty trucks to performance vehicles.

“Much like the pack design of [our] Ultium batteries, which is flexible enough to incorporate new chemistry over time as technology changes, the wBMS’ basic structure can easily receive new features as software becomes available,” claims Helfrich.

“Scalability and complexity reduction are a theme with our Ultium batteries,” explains Helfrich. “The wireless battery management system is the critical enabler of this amazing flexibility. [It] represents the epitome of Ultium’s configurability and should help [us] build profitable EVs at scale.”

According to Helfrich, the wBMS will help GM’s electric vehicles balance chemistry within the individual battery cell groups for optimal performance. It can also conduct real-time battery pack health checks, and refocus the network of modules and sensors as needed to help safeguard battery health over a vehicle’s lifespan.

“By reducing wires within the batteries by up to 90 percent, the wireless system can help extend charging range by creating lighter vehicles overall and opening extra room for more batteries,” Helfrich points out. “The space and flexibility created by this reduction in wires not only enables a cleaner design, but also simpler and more streamlined battery restructuring as needed, and more robust manufacturing processes.”

The Ultium Drive family covers front-wheel drive, rear-wheel drive and all-wheel drive propulsion combinations, including high-performance and off-road capabilities. Photo courtesy General Motors

Assembly Plants

GM has decided not to build a new U.S. factory dedicated to electric vehicles. Instead, it plans to reconfigure several existing facilities: two in the Detroit area and one in Tennessee.

The automaker’s flagship EV plant will be the Detroit-Hamtramck factory that was teetering on the verge of shut down just a few years ago. Instead, it has now been resurrected and rebranded as Factory Zero, which will become GM’s first fully dedicated electric vehicle assembly plant.

The plant is being completely retooled with a $2.2 billion investment, the largest ever for a GM manufacturing facility. Its body shop, paint shop and general assembly area will receive comprehensive upgrades, including new machines, conveyors, controls and tooling. In addition to the Hummer EV, GM also plans to produce the Cruise Origin autonomous vehicle at the plant.

“Through this investment, [we are] taking a big step forward in making our vision of an all-electric future a reality,” says Mark Reuss, president of GM. “Our electric pickup will be the first of multiple electric truck variants we will build at Detroit-Hamtramck over the next few years.

“The name Factory Zero reflects the significance of this facility in advancing GM’s zero-crashes, zero-emissions and zero-congestion future,” explains Reuss. “[It] will be the launchpad for [our] multibrand EV strategy. The facility has advanced technology and tooling, and was designed with a focus on sustainable manufacturing.”

“Factory Zero is the next battleground in the EV race and will be [our] flagship assembly plant in our journey to an all-electric future,” adds Gerald Johnson, executive vice president of global manufacturing. “The electric trucks and SUVs that will be built here will help transform GM and the automotive industry.”

Better integration between vehicles and battery packs will enable GM engineers to use fewer cells and modules. Photo courtesy General Motors

Factory Zero recently became the first automotive plant in the U.S. to install dedicated 5G fixed mobile network technology. Verizon’s 5G ultra wideband service, which features dramatic increases in both bandwidth and speed, is supporting the ongoing transformation of the plant as it prepares to begin producing EVs.

“Installing 5G at Factory Zero is an essential step in the transformation of this plant, and signals how important advanced manufacturing is in the ongoing race to an EV future,” says Phil Kienle, vice president of North America manufacturing and labor relations.

“Today, the Internet of Things is transforming manufacturing plants, enabling connected devices to deliver important benefits to quality and safety,” notes Kienle. “Countless systems and equipment rely on connectivity, such as robots, sensors and the automated guided vehicles that deliver materials across the factory floor.

“Our workers rely on fast and reliable communication and need to trust their tools, including digital tools,” explain Kienle. “Factory Zero is an ideal place for this kind of innovation, as it’s being transformed to become our most advanced assembly plant.”

GM’s commitment to increased vertical integration should drive additional cost efficiency. Photo courtesy General Motors

About the Author

Austin has been senior editor for ASSEMBLY Magazine since September 1999. He has more than 21 years of b-to-b publishing experience and has written about a wide variety of manufacturing and engineering topics. Austin is a graduate of the University of Michigan. Author image courtesy of Weber.

According to Kienle, key benefits of 5G in a manufacturing plant include reliability, speed and sheer scale. “5G’s massive bandwidth offers the possibility to manage thousands of devices across Factory Zero’s more than 4 million square feet of space, with ample capacity to support emerging technologies,” he explains.

GM is also investing in its factory in Lake Orion, MI, that assembles the Chevy Bolt. The 4-million-square-foot Orion Assembly plant will produce a new electric vehicle that will be designed and engineered based on an advanced version of the current Bolt architecture. In Canada, GM's CAMI facility in Ingersoll, ON, will assemble the BrightDrop EV600 delivery truck.

In addition, the 30-year-old Spring Hill complex will receive a $2 billion facelift to build EVs such as the Cadillac Lyriq. The plant, which was originally built to produce Saturn sedans, is one of GM’s largest facilities.

Spring Hill’s paint and body shops will undergo major expansions and the general assembly area will receive comprehensive upgrades, including new machines, conveyors, controls and tooling.

In addition to EVs, the revamped facility will build traditionally powered Cadillacs. For instance, production of the XT5 sedan and the XT6 crossover will continue at Spring Hill.

An Ultium battery undergoes leak testing at GM’s tech center in Warren, MI. Photo courtesy General Motors