This custom test stand is designed to accommodate a wide range of small, high-speed electric motors. Photo courtesy ACS Inc.

The dawn of the EV era is changing motor testing.

David Suehs // Engineering Manager // ACS Inc.

Matt Thiel // Director of Facility Planning and Integration // ACS Inc.

Evolution,

Not Revolution

The internal combustion engine may not be dead, but it has lost its spot in the limelight. The global demand for energy without emissions is driving markets and policy. In response, the world has turned its attention to electrification as the future of transportation.

Countries such as Canada, England and France have set deadlines for the final sale of new gas-or diesel-powered passenger vehicles. They hope for a not-too-distant future in which tailpipe exhaust is a thing of the past. Norway plans to end the sale of new petroleum-powered vehicles as early as 2025, followed by at least nine other countries by 2030. In the United States, California has declared that new vehicle sales will be limited to electrics only by 2035.

Such regulations dovetail with growing consumer demand. While only 7 percent of Americans currently own an electric car or truck, nearly 40 percent said they would consider going electric for their next vehicle purchase.

Demand fuels innovation. In recent years, the technology behind electric vehicles has made tremendous leaps forward. Only a few years ago, EVs were something of a novelty the Big 3 automakers were experimenting with. Tesla came on the scene as a dark horse, showing traditional automakers the public was poised to embrace electric options.

In 2021, there were 19 fully electric passenger vehicle models available in the U.S.—only four of them Tesla’s. Within the next five years, automakers plan to release dozens more.

Of course, the internal combustion engine (ICE) market is not limited to passenger vehicles. ICEs power everything from lawnmowers to heavy mining equipment, and only a fraction of those markets currently offer electrified options. Despite the rapid advancement of electric power train and drivetrain components, there are likely to be applications (and debates) for which ICEs continue to outstrip them when it comes to overall effectiveness or power density.

Although the good old ICE is far from dead, forward-looking manufacturers are making space and investing resources to develop, test and build electric motors and power trains. With all this disruption occurring today, here are three facts that all engineers should pay attention to.

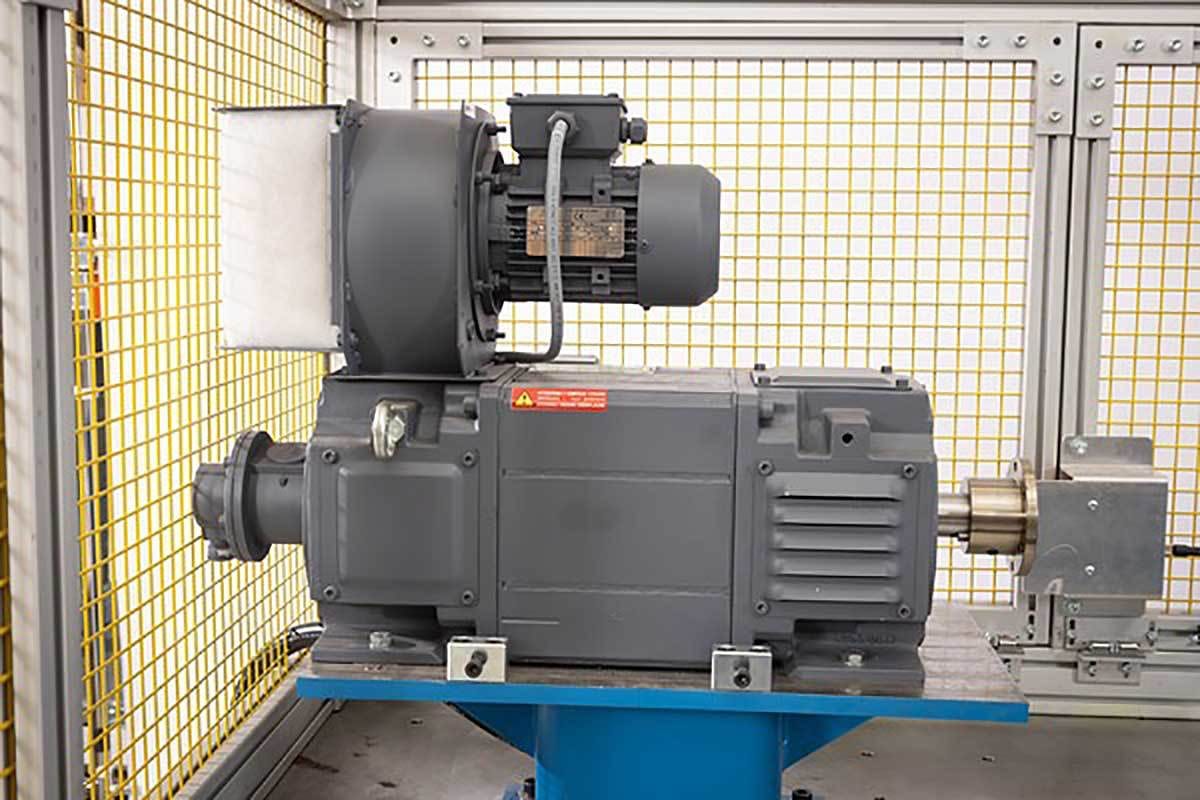

This electric transmission assembly manually mounts to a motor for testing. Photo courtesy ACS Inc.

Existing Test Cells Can Be Adapted to Electric Needs

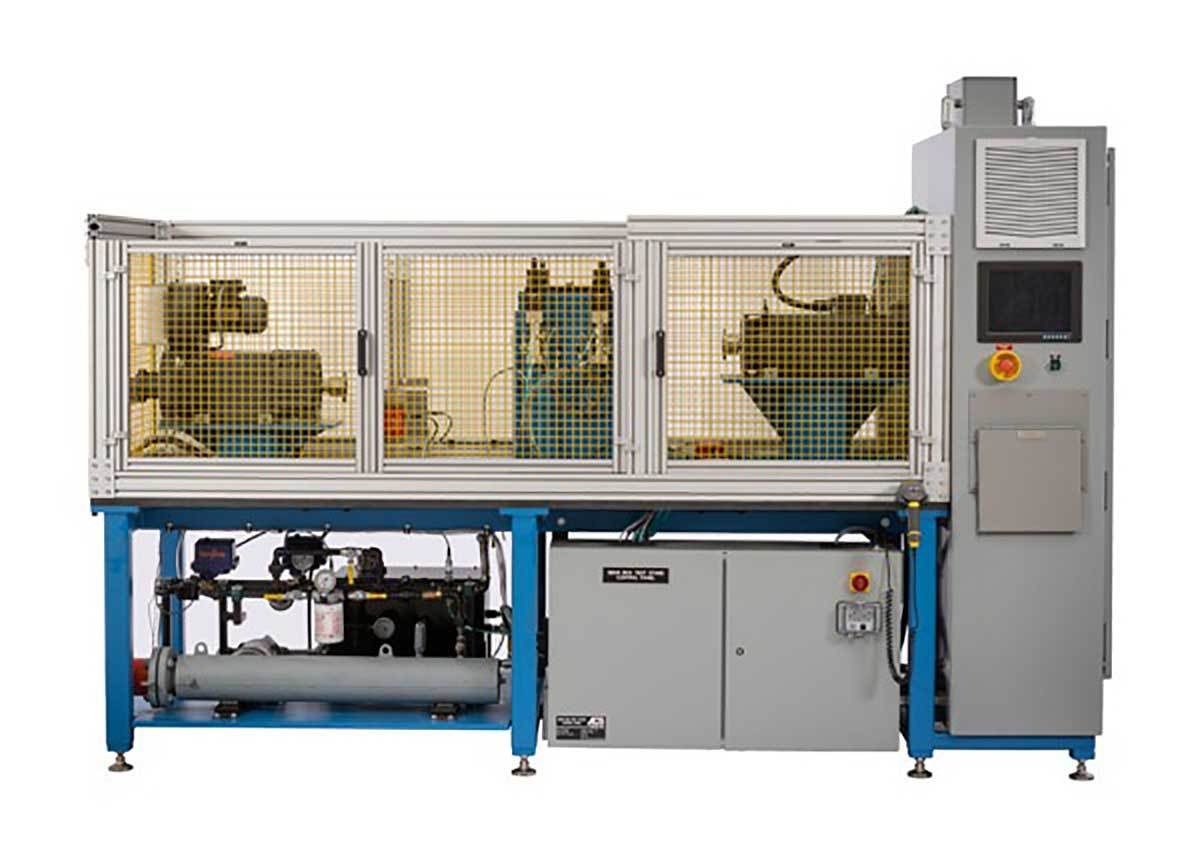

Switching to electrified systems means adapting test processes all along the development and assembly chain. In the design stage, testing ensures that a product functions as envisioned and that performance is fully realized. Tests during production monitor for defects and manufacturing efficiency. Quality assurance tests are key to verifying that finished products are up to a manufacturer’s standards.

In many cases, facilities can switch from testing ICEs to testing electric motors and drive systems without a complete overhaul. At the end of the day, both systems convert energy into rolling motion. They measure and control torque, speed, power, flow and temperature. And both require a way to absorb mechanical energy and simulate real-world output.

According to some experts, repurposing existing testing space and equipment can cut the cost of switching to electric by as much as two-thirds. For example, by 2030, General Motors expects half of its North American manufacturing footprint will be dedicated to EV production. All this activity will take place in facilities currently building gasoline-powered vehicles. GM projects that refurbishing old factories instead of building new ones will save an estimated $1.5 billion per plant.

This electric transmission assembly test stand verifies production quality. Photo courtesy ACS Inc.

Similar, But Not the Same

Testing electrified systems is similar to testing ICEs, but it’s not the same. Electric power trains require more precise measurement of voltage and current. While these are less critical measurements in an internal combustion test, they become high priority in an electrified test. The test system needs to be able to measure these elements at a relatively high data acquisition rate. This typically requires new and upgraded measurement systems and equipment.

In addition to the prime mover components, an electric power train can have multiple small motors powering components like fans and pumps—some at much higher rotational speeds than many testers are used to. These high speeds don’t always involve more net power, but they do pose new safety hazards to be aware of.

Another potentially significant difference between internal combustion, electric or hybrid test cells is the increase in facility power consumption. Depending on the test cycles, battery cyclers and test stands with battery simulators can require tremendous amounts of electricity.

The way these electric machine and power supply systems are built and the way they interface with utilities is critical. In some cases, there will be large current flow to drive the test. In other cases, the power may be cycled around a common DC bus. In all cases, the test and equipment approach must be considered in light of the facility and local electric utility.

This 3D model depicts a modular enclosure for testing EV power train components. Illustration courtesy ACS Inc.

New Systems, New Safety Concerns

As with most product development evolutions, there are certain trade-offs. Test cells for electric motors and drives have different needs with respect to fluids, temperature, ventilation and vibration than those for ICEs, typically requiring much less. On the other hand, electric components introduce new safety hazards in the form of high voltage, high current and battery chemistry.

Most businesses cite worker safety as a top priority. When implementing test systems, regardless of the power source, the safety of the people running the tests and everyone nearby is paramount.

The most obvious risk in testing electrified equipment is the risk of electric shock. High voltage is an invisible danger people used to working with ICEs are not conditioned to think about. It is critical to protect people from high voltage and current. Specific processes and mechanisms are needed to cut power or dissipate electrical energy in a controlled fashion.

Electric components come with other, less obvious dangers to be considered in test cell design. For instance, some types of motors may have parts spinning at tremendous speeds. A safe test cell must account for rotational speeds and imbalances that may not have been considered in the past.

Battery packs pose other safety considerations. Each battery pack may contain hundreds of cells. If any one of those cells is defective, it could lead to a chain reaction.

ICEs rely on controlled petrochemical combustion reactions to develop power. The inherent risks related to uncombusted fuel and fire protection are well understood in ICE test labs. However, battery fires are entirely different. Depending on the makeup of the battery, the chemical reactions inside can burn without external oxygen. The timescale of the energy release can render typical fire suppressants ineffective.

These safety challenges have led to rising interest in modular test cells. Standalone units can be located outside of the main facility and are not tied into the larger plant’s infrastructure. When a battery fire starts in a burn box or a modular unit, it can be left to burn out without presenting a danger to people or property. Should a battery or battery pack experience a catastrophic failure, modular cells contain the damage without putting the rest of the facility at risk.

This lithium-ion battery pack and battery module production verification stand is designed to handle multiple devices under test. Photo courtesy ACS Inc.

Preparing for an Ever-Changing Future

Electric power technology is advancing at a breakneck pace. For companies trying to be proactive, futureproofing can feel like a daunting task. By the time you’ve adapted to the latest advancement, a new one has come along to take its place. Fortunately, testing structures for electrified systems can be relatively versatile.

An ICE test cell needs systems to manage air, fuel and exhaust. But, an electrified test cell has none of these needs. As a result, in many cases upgrading an electric test cell to test higher loads is relatively straightforward. A company may need to swap out sensors and drives, and perhaps add some power capacity. If this capacity change was planned at the outset, it takes only a few adjustments to be ready to test the next generation of designs.

The biggest considerations in preparing for test cell needs of the future are scale and infrastructure. For example, a company testing battery cells that envisions eventually testing battery packs needs room to expand. As tests increase in complexity, they may also increase in power draw. Manufacturers should be prepared to work with utilities to get the power they will eventually need and understand the implications of regeneration to the grid.

The surge in electrification is more evolution than revolution. It comes after decades of research and development that led first to hybrid power systems, then to fully electric power trains. As pioneers in the enabling technology showed proof of concept, investment increased. Efficiency is now rising and production costs are tumbling.

Technology makes electric machine development and production more attainable just as the demand for lower emissions makes battery-powered vehicles more desirable. Forward-thinking suppliers and OEMs are keeping informed of the technical nuances of this energy evolution. Futureproofing means planning for space and power, and being open to what comes next. Those who invest wisely in their ability to adapt will position themselves at the front of the pack.