CONTACT

Austin

Manufacturers need to avoid making four common mistakes.

How to Meet Battery Production Needs in the Next 10 Years

Ashwin Zalte // Senior Technical Program Manager // Google LLC

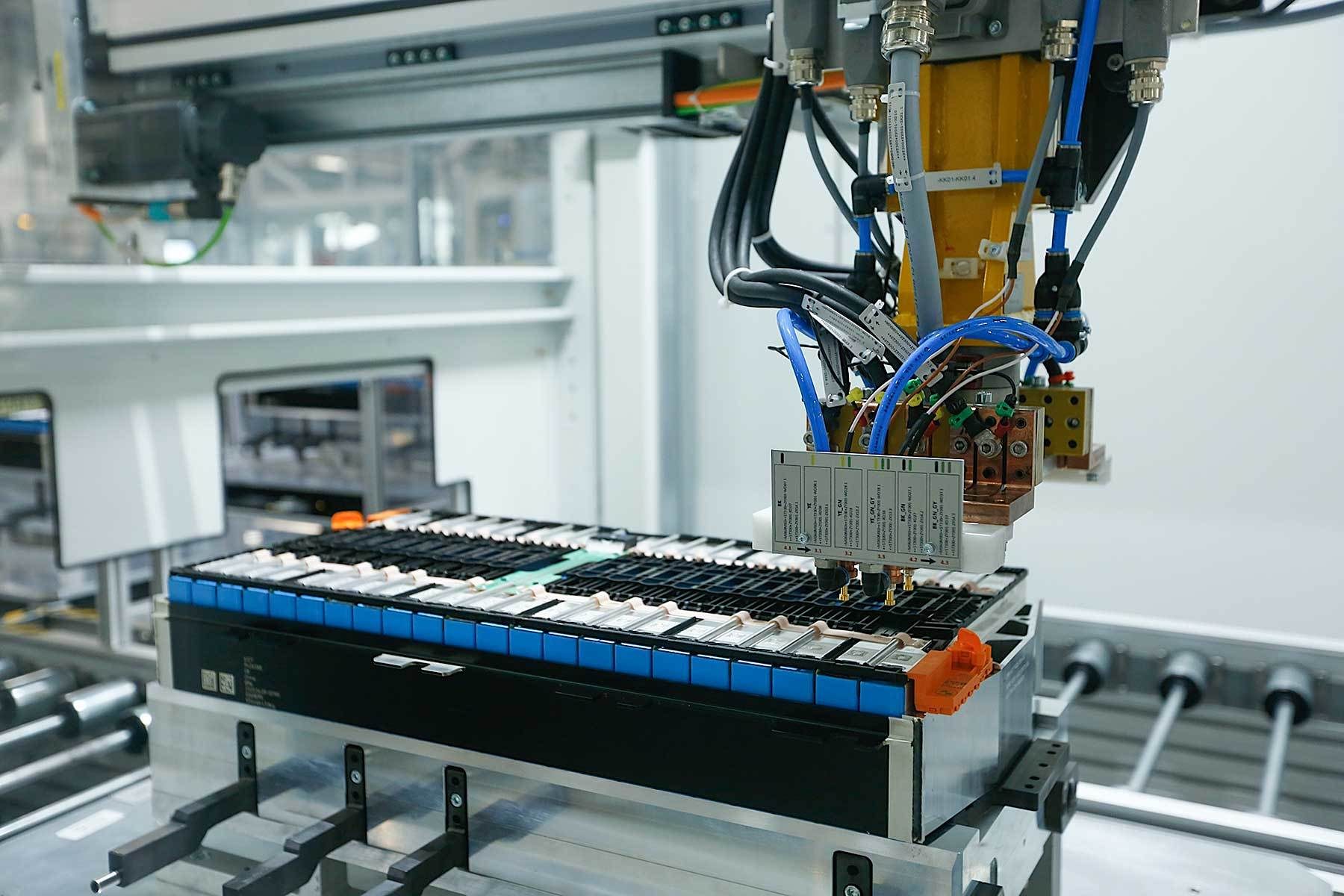

Automakers have an insatiable appetite for lithium-ion batteries. Photo courtesy Audi AG

Manufacturers need to avoid making four common mistakes.

Ashwin Zalte

Senior Technical Program Manager

Google LLC

How to Meet Battery Production Needs in the Next 10 Years

Battery manufacturers tend to be conservative in their efforts to maximize production processes and still maintain sustainable assembly costs. To overcome profitability and product development challenges during the next decade, companies need to invest in research and development, improve volumetric energy density and address supply chain issues.

Due to unprecedented demand for batteries, the next decade will witness phenomenal growth. In fact, the compound annual growth rate for the global battery market is projected to reach more than 14 percent by 2027, while the battery-electric vehicle market is forecast to exceed $300 billion during the same time period. Globally, the lithium-ion battery market, currently valued at more than $41 billion, will skyrocket to more than $116 billion by 2030.

The number of EVs in use worldwide surpassed 10 million in 2020. But, battery demand will soon exceed current production capacity. This monumental growth is fueled by several factors, such as evolving environmental regulations, higher OEM sustainability targets and increased consumer demand.

Historically, Japan and South Korea have been the two largest suppliers of the cells used in EVs sold in the United States. Poland and China are close behind, thanks to suppliers of popular vehicles such as the Ford Mustang Mach-E and the Tesla Model Y. But, that market share will shift dramatically by the end of this decade.

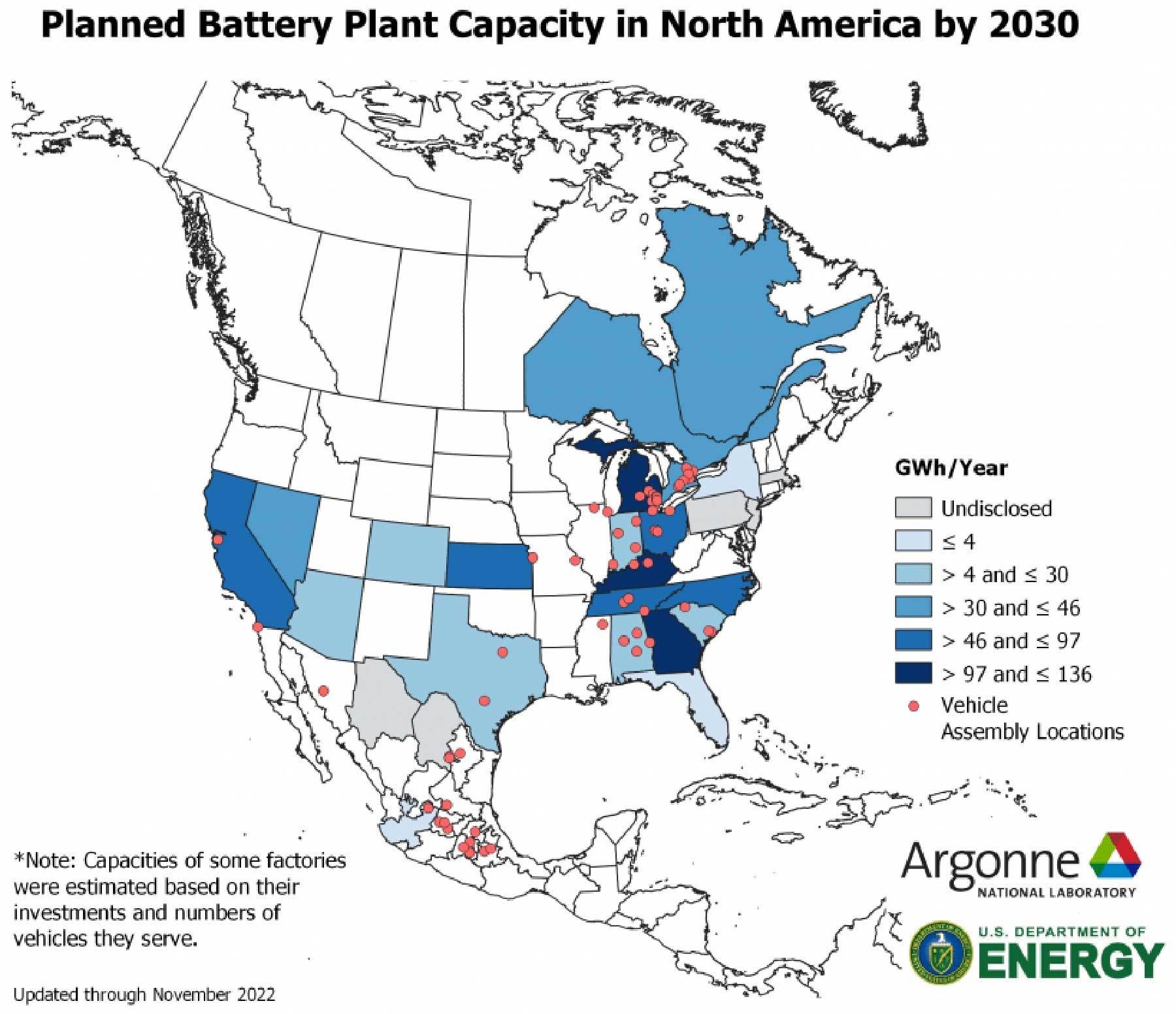

According to a recent report conducted by Argonne National Laboratory, a wave of new planned EV battery plants will increase North America’s battery manufacturing capacity from 55 gigawatt-hours per year (GWh/year) in 2021 to nearly 1,000 GWh/year by 2030.

Most of the announced battery plant projects are scheduled to begin production between 2025 and 2030. By 2030, this production capacity will be capable of supporting the manufacture of roughly 10 million to 13 million all-electric vehicles per year.

To optimize supply chain logistics, many battery factories will be co-located with vehicle assembly plants. Most of the planned projects in the U.S. are concentrated along a north-south band from Michigan to Alabama. Based on current plans, Georgia, Kentucky, Michigan and Tennessee will see the highest growth in battery manufacturing capacity.

To optimize supply chain logistics, many battery factories will be colocated with vehicle assembly plants. Photo courtesy BMW AG

This does not mean the materials must be impurity-free. In fact, some impurities can be helpful, while others can create catastrophic failures, which result in internal swelling, shorts and fires. For example, while the presence of a low amount of copper enhances the discharge rates of lithium-ion batteries, excess copper will decrease performance.

Lithium ion offers fundamental advantages over other chemistries—in particular, the lowest reduction potential of any element. This allows these batteries to have the highest possible cell potential. Lithium ion is also the third lightest element and has one of the smallest ionic radii of any single charged ion. That’s two big reasons why these batteries have high gravimetric and volumetric capacity and power density.

Although multivalent cations allow for higher charge capacity per ion, the additional charge significantly reduces their mobility. Given that ionic diffusion in the solid electrodes is often the rate-limiting factor for battery power performance, this presents an enormous hurdle for the development of such alternative chemistries.

Four Common Mistakes

There are four common mistakes that plague battery manufacturersand impede production:

- Failure or lack of research to develop new, safer and more efficient materials.

- Failure to improve volumetric energy density within a given footprint.

- Failure to adopt more efficient, proven production technology.

- Failure to recognize and address supply chain issues. While these mistakes present major challenges today, progress is being made and opportunities exist for industry collaboration that can deliver new solutions, new products and a bright future.

To meet future marketplace demand, manufacturers need to research, identify and develop new materials and chemistries to create more powerful, longer lasting batteries. Due to the dominance of lithium-ion batteries, it is essential to first focus on the development of raw materials.

One way to accomplish this is to use materials with the fewest unnecessary impurities, ensuring the development of a lithium-ion battery that will last the maximum number of cycles.

This does not mean the materials must be impurity-free. In fact, some impurities can be helpful, while others can create catastrophic failures, which result in internal swelling, shorts and fires. For example, while the presence of a low amount of copper enhances the discharge rates of lithium-ion batteries, excess copper will decrease performance.

Lithium ion offers fundamental advantages over other chemistries—in particular, the lowest reduction potential of any element. This allows these batteries to have the highest possible cell potential. Lithium is also the third lightest element and has one of the smallest ionic radii of any single charged ion. That’s two big reasons why these batteries have high gravimetric and volumetric capacity and power density.

Although multivalent cations allow for higher charge capacity per ion, the additional charge significantly reduces their mobility. Given that ionic diffusion in the solid electrodes is often the rate-limiting factor for battery power performance, this presents an enormous hurdle for the development of such alternative chemistries.

As more electric vehicles are produced, demand for batteries will grow at least 30 percent annually. Photo courtesy IEEE

Beware of Dendrites

Understanding the growth mechanism of lithium dendrites is important in improving battery performance and safety.

A lithium-ion battery operating in abnormal conditions, such as overcharging or lower temperature charging, can lead to dangerous lithium dendrite growth or lithium plating. Lithium dendrites are metallic microstructures that form on the negative electrode during the charging process. They are formed when extra lithium ions accumulate on the anode surface and cannot be absorbed into the anode in time.

Dendrites can cause short circuits and lead to catastrophic failures and even fires. They can also create a drop in energy capacity when they react with the electrolyte, causing it to decompose and trigger the loss of active lithium inside the battery.

Lithium dendrite growth is influenced by several factors, including current density, temperature, electrolyte and electrolyte convection. These factors determine the electrolyte dynamics..

The continuous development of new chemistries, processes and procedures is the ideal way for manufacturers to protect market share and streamline production across a wider range of products and customers. For example, sodium and sulfur are ideal materials for future battery production, because they are less costly and more widely available than materials such as lithium and cobalt.

Manufacturers must fund and carry out more research to identify and develop new materials that can maximize battery life and performance, while they eliminate or dramatically reduce potential safety issues created by the materials.

Another way to overcome production and profitability challenges is to improve volumetric function of the battery, or its volumetric energy density. A battery with a higher energy density will be lighter and smaller than a similar capacity battery with lower energy density. High energy density batteries provide distinct advantages in two areas: operating portable electronics and transporting batteries to remote locations.

Unlike energy density, power density defines how much power a battery can deliver on demand, while energy density defines how long the battery will perform under normal conditions. Further improvement can be provided by developing lithium-sulfur batteries to provide higher, safer levels of energy at significantly lower costs.

Development of new chemistries, intellectual property and potentially new patents will provide opportunities to improve energy densities, lower production costs, boost profits and meet surging demand for batteries.

Battery manufacturers will soon be forced to implement new systems that allow for continuous improvement, boost production, enhance quality and ensure safety. Photo courtesy BMW AG

How to Streamline Production

One way to maximize battery production is to implement continuous process improvement and lean manufacturing techniques. Continuous improvement includes the ongoing collection of production data to improve processes instead of simply adapting old manufacturing processes to produce new-styled batteries. Using the same equipment and processes to serve multiple customers can easily result in lower production rates and lower quality products.

Many battery manufacturers currently rely upon mechanical data gathering systems simply because they are less costly than implementing optical datum systems. However, mechanical systems have distinct limitations that can inhibit a manufacturer’s ability to maximize production across multiple product lines efficiently. Ultimately, the worst possible scenario is a single battery module overheating due to a faulty connection that ignites the battery and an entire EV.

Mechanical data gathering systems may not detect battery block placement errors, eliminating the possibility of intervention and positioning adjustments impacting downstream production and product quality. In addition, they do not collect data that would allow for ongoing process improvement.

Optical systems differ from mechanical systems. They use optical sensors, cameras and 3D-like scanners to “see” the part location instead of simple mechanical measurements. Optical positioning systems enhance the battery manufacturing process by improving the ability of equipment to complete a specified process in the exact location required, even if the battery block is out of position.

The system adapts to each battery block in the process and verifies accuracy before, during and after welding or other operations. This lowers cost in the long run by reducing the need for human inspection while boosting quality.

Speed and quality of battery pack assembly are influenced by the precision of the measurement and welding methods used in the process. The quality of assembly in EV battery production is the cumulative impact of part tolerances, assembly features and welded joint quality.

Because optical systems rely upon images, they can quickly be adapted to produce new types of batteries faster and at lower cost than changing a mechanical system. In addition, optical systems can easily be used in continuous process improvement to enhance manufacturing tolerances and product quality, while reducing downtime during product line changeovers.

A wave of new planned EV battery plants will increase North America’s battery manufacturing capacity by the end of this decade. Illustration courtesy Argonne National Laboratory

An Efficient Supply Chain Is Crucial

The bulk of battery manufacturing occurs in Southeast Asia, which has resulted in an unbalanced supply chain. At the same time, raw materials for battery production worldwide are subject to changing geopolitical forces beyond the control of most individual companies. These combined forces impact the quantity and quality of materials in the supply chain and, ultimately, end products.

It takes an inordinate amount of time to develop a fully efficient supply chain. Establishing supply chains for some materials, such as lithium-hydroxide, can take anywhere from three to seven years. The situation was worsened by the COVID pandemic and an already existing supply shortage.

In the future, the best options for worldwide battery companies will be to work collaboratively to develop new supply sources, resolve supply chain issues and boost production. This requires the development of a stable, safe, high quality supply chain that enables manufacturers to double battery energy production levels in the next five years.

Worldwide supplier diversification and strategic partnership are also key to individual company success. In response, some automakers and battery suppliers are forming alliances and localizing supply chains to ensure quality and availability.

The global battery manufacturing industry clearly faces numerous challenges, the greatest of which is demand exceeding production capacity. As demand grows during the next decade, manufacturers must adopt a collaborative effort to research and develop new materials and battery types, maximize battery quality, develop new manufacturing processes and overcome supply chain issues. Only a complete transformation of the industry will ensure the stability of the marketplace while meeting rising demands.

FEBRUARY 2023 | ASSEMBLYMAG.com