Nissan recently opened a pilot production line in Japan to make solid-state batteries. Photo courtesy Nissan Motor Corp.

The next big breakthrough in EV power is just around the corner.

Matt Cousineau // Contributing Writer

Solid-State Batteries Emerge From the Lab

Solid-state batteries use solid electrolytes, not liquid, which results in a higher energy density than traditional lithium-ion chemistries. After years of development, they promise to be the next big trend in electric vehicle technology.

Benefits include faster charging, greater energy density, longer cycle life and thermal stability. Pilot production lines are starting to emerge and mass-production could start by 2023. Automakers such as BMW, Daimler, Ford, Nissan, Toyota and Volkswagen are leading the way, in addition to start-ups such as ProLogium, QuantumScape and Solid Power. Electrovaya, LG, Panasonic, Samsung and other traditional battery manufacturers are also actively pursuing the technology.

Solid-state batteries come in two types. All-solid-state batteries (ASSB) have no liquid electrolyte. Hybrid solid-state batteries have some liquid electrolyte. Neither type has reached widespread commercial viability. However, automakers and suppliers are scrambling to develop solid-state technology because it holds promise for improving the lithium-ion cells typically used in battery packs.

While some companies gear up for limited production, engineers continue to work on a number of issues, including battery chemistry and cost, that still need to be addressed before solid-state batteries can be widely used.

Solid Power’s initial Silicon EV Cell design includes 40 double-sided cathodes and 41 anodes. Photo courtesy Solid Power Inc.

Solid Breakthroughs and Possibilities

A cell is the basic building block of all batteries. It includes an anode, a cathode and an electrolyte. Anodes and cathodes are electrodes, and electrolyte is a substance that has ionic conductivity. When a cell is charged, ions move from the cathode to the anode. Cells supply power when ions go from the anode to the cathode.

Oxide, sulfide and polymer electrolytes are in development for solid-state batteries. Oxides have a relatively large composition of lithium and oxygen, whereas the prevailing elements for sulfides are lithium and sulfur. Polymer electrolytes for solid-state batteries are made of polyethylene oxides.

Engineers at Nissan Motor Corp. are developing ASSB cells in a pouch-format through a process that includes lamination. “In this lamination step, the cathode, the solid electrolyte separator, the anode and the current collector are brought together and pressed onto each other via rollers,” explains a recent report from the Fraunhofer Institute.

“In the feasibility study, we have been able to confirm the realization of high energy density, rapid charging performance and durability performance,” adds a Nissan spokesperson.

There are breakthroughs in anodes, as well. “Two of the biggest breakthroughs for solid-state batteries are the lithium-metal or anode-less anode, and the 100 percent alloy-based [anode], such as silicon,” says Darren H.S. Tan, Ph.D., CEO of UNIGRID Battery, a San Diego-based start-up developing ASSB technology.

The Fraunhofer Institute’s report explains why this is a breakthrough, stating: “One of the main drivers toward implementing solid-state batteries is the possibility of being able to use lithium metal as the anode active material, which enables the fabrication of batteries with [the] highest energy density.”

Silicon anodes are a breakthrough for a similar reason. “Alternatively, silicon anodes are also considered promising, as they can achieve high energy densities (although lower than lithium anodes).”

The so-called anode-less battery is also a breakthrough. “The idea is that during the formation of the battery (in the first controlled charge and discharge cycles), the lithium-ions stored in the cathode are plated onto the anode current collector during the first charging cycle, thereby forming the lithium metal anode in-situ,” explains the report. “Lithium plating avoids the direct handling of lithium metal, it enables very thin layers to be applied and can, in principle, lead to the highest possible energy densities, since no excess lithium is introduced into the cell.”

Visit us at Booth 431

This automated stacking machine is part of a pilot production line. Photo courtesy Solid Power Inc.

Electrolyte materials are also showing progress. “On the oxide side, some companies have made progress toward making thin film, solid electrolytes out of oxides,” says Albert Lipson, Ph.D., principal materials scientist at Argonne National Laboratory.

Producing thin-film solid electrolytes is a key development, because the process of making these oxide electrolytes can compromise their performance as battery materials. “These types of oxides may begin as solutions or powders,” explains Lipson. “Typically, there is an intermediate step where you have created the composition you want in a powdered form. This then needs to be made into sheets that can be used as the solid electrolyte. That typically requires high temperatures for oxide materials.”

However, heating up oxides during production introduces some risks. “Making thin (10 to 15 microns thick) electrolytes out of oxides is extremely challenging,” Lipson points out. “They have a high melting point and begin to lose lithium content at those temperatures, which ruins their ionic conductivity.”

Solid electrolytes based on sulfur are also being developed. “There’s exciting developments in the sulfur battery space, or the sulfur-type electrolytes,” adds Lipson. “[We’re] getting closer to cells of the size we need for electric vehicles.”

Solid polymer electrolytes provide some advantages. “You’re going to have levels of efficiency that could make things easier in terms of cell manufacturing and ultimately the manufacturing of the battery pack,” says Donald Sadoway, Ph.D., a professor of materials chemistry at the Massachusetts Institute of Technology (MIT). “The polymer is flexible. That means you can continue to have either a flat format pouch-type cell or you can coil them up into jellyroll configurations.”

Toyota has been testing solid-state batteries in this prototype car. Photo courtesy Toyota Motor Corp.

Pilot Production Lines

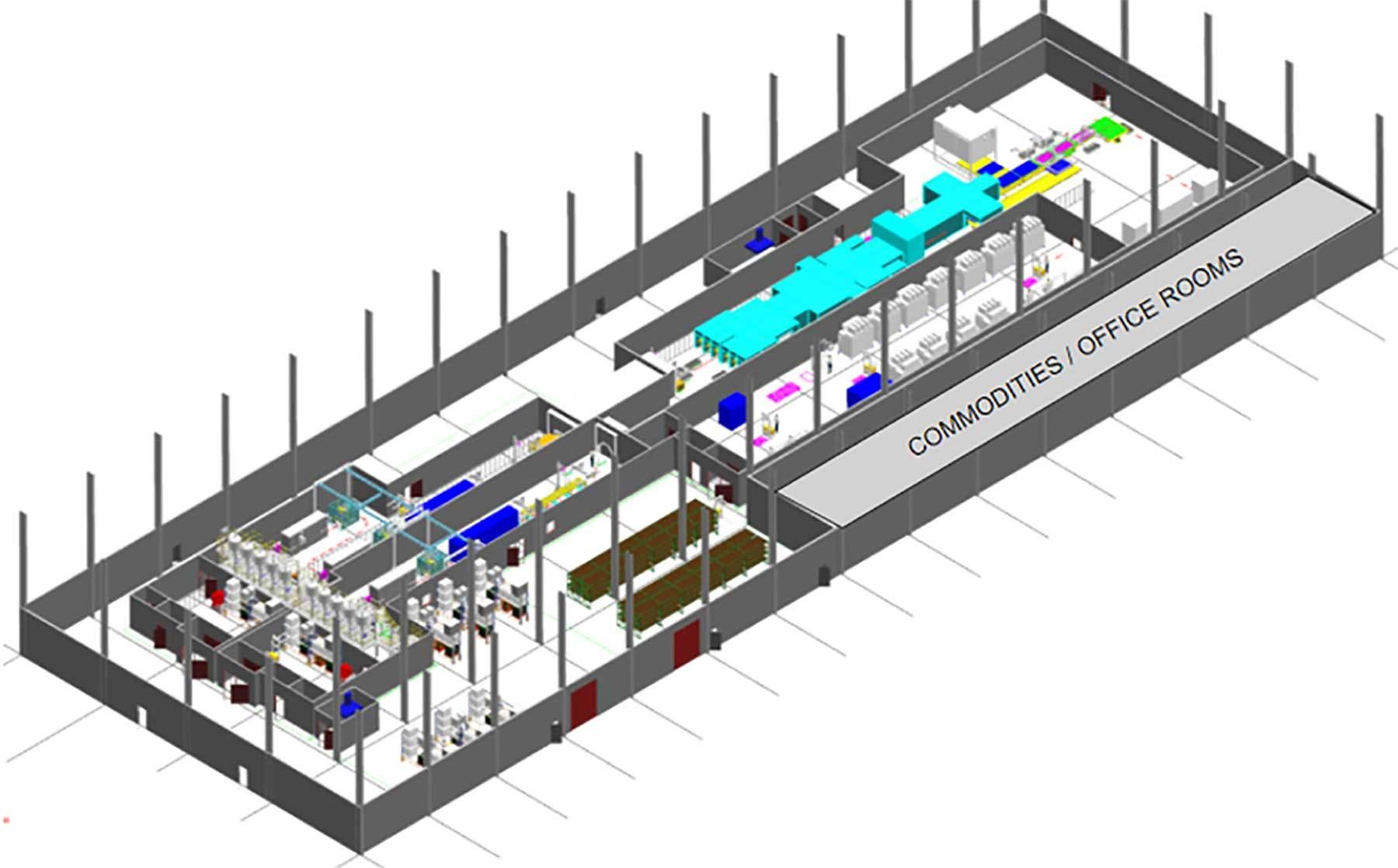

Some companies, such as Nissan and Solid Power, are setting up pilot production lines to streamline processes and work out issues before mass-production initiatives begin in a few years.

Nissan believes all-solid-state batteries can be reduced to $75 per kilowatt-hour (kWh) by 2028 and to $65 per kWh thereafter, which would place EVs at the same cost level as gasoline-powered vehicles. To achieve that goal, the automaker recently set up a prototype facility at its R&D center in Japan.

Nissan is prototyping a 10-by-10-centimeter laminated cell as part of a feasibility study line that was unveiled earlier this year. A pilot production line will be established at its Yokohama Plant by 2024.

Battery manufacturers are also busy building preproduction facilities. For instance, Solid Power Inc. recently announced the installation of an EV cell pilot line that will produce EV-scale all-solid-state batteries. It will be used for internal testing before delivering cells to BMW and Ford for qualification testing by the end of this year.

“This will allow us to produce EV-scale cells suitable for initiating the formal automotive qualification process,” says Will McKenna, marketing communications director at Solid Power. “To our knowledge, no other solid-state battery has formally entered automotive qualification testing.”

By using more than 50 percent active silicon in its anode, Solid Power has designed the cell for increased energy density to address range anxiety, a key barrier to mass EV adoption. Its initial Silicon EV Cell design includes 40 double-sided cathodes and 41 anodes.

The pilot line is designed to produce large-format sulfide-based cells in a manner that mimics traditional lithium-ion production processes. When running at full capacity, the line will be capable of producing 300 cells per week or approximately 15,000 cells per year.

Most of the production equipment currently used to mass-produce lithium-ion battery cells should also be usable with solid-state technology.

“We have just finished a collaboration project with Comau that concluded that two-thirds of the equipment required for lithium-ion battery production can be used for solid-state batteries, with the rest requiring small [modification of] equipment,” says Denis Pasero, product commercialization manager at Ilika Technologies Ltd. “This demonstrated that a transition can be cost efficient.”

Beyond cost, there are additional reasons why lithium-ion production procedures can be applied to solid-state batteries.

Sebastian Heinz, chief sales officer at High Performance Battery Holding, claims that his company’s solid-state electrolyte can use procedures from liquid electrolyte battery manufacturing that “…allows for a short time to market and less difficulties in scaling up production.”

Solid-state-batteries provide an extra mileage advantage because of their lighter weight and smaller volume for the same capacity. Photo courtesy ProLogium

Numerous Challenges

Despite recent breakthroughs, many issues persist, such as the moisture sensitivity of solid-state chemistries with sulfide electrolytes.

“Most of the sulfide electrolytes will react with water in the air and form hydrogen sulfide, a toxic gas that obviously creates a lot of problems from a safety standpoint,” says Argonne National Laboratory’s Lipson. “It also degrades the electrolyte performance significantly.

“A lot of people [in R&D labs] are mostly producing these in very carefully controlled gloveboxes to keep all the moisture down below 1 part per million,” explains Lipson. “It’s not all that practical from a commercial standpoint, and there’s questions of how to handle that in a dry room, which is more typical of lithium-ion battery production right now.”

According to Lipson, cathode materials also present unresolved issues. “And, then one of the things that has yet to be fully solved is how to integrate cathode materials into these solid-state batteries,” he points out. “[Some engineers] get these to work very well with lithium on both sides of the electrolyte.

“They can measure it in properties,” notes Lipson. “But, actually integrating that with an energy-dense cathode, meaning enough material to actually reach the high energy densities that solid-state can potentially deliver, is [still] a challenge. There’s a lot of surfaces. There is also a lot of reactivity between the electrolytes and the materials.”

Two-thirds of the equipment required for lithium-ion battery cell production can also be used with solid-state batteries. Illustration courtesy Ilika Technologies Ltd.

Hybrid solid-state batteries with a lithium-metal anode pose another safety issue. “In cases where you have lithium-metal in contact with a liquid electrolyte, potential safety problems start to arise after the battery is extensively cycled,” warns UNIGRID Battery’s Tan. “It is safe at the onset when lithium metal is still dense, so it will pass most safety testing on day one. But, after several hundred charge and discharge cycles, it starts to become quite dangerous.”

Boosting the cycle count of solid-state batteries is also an issue for some developers.

“Cycle count is how many charge-discharge cycles you can do on that battery before you consider it end-of-life,” says Rajshekar DasGupta, Ph.D., CEO of Electrovaya Inc. “We have cells that are getting nearly 10,000 cycles. Those are used for heavy-duty commercial vehicles.

“However, for [hybrid] solid-state batteries, the target is quite different,” explains DasGupta. “It’s more like 800 cycles. It’s an order of magnitude different. You don’t need it to cycle forever for an automotive or even a consumer electronics application. We’re nearly there, but we haven’t reached it yet.”

DasGupta says solid-state battery cost is also an issue. Compared to more commercially viable batteries, the technology is still too expensive.

“Currently, the cost of these [sulfide] precursors mean that the solid electrolyte costs about two orders of magnitude more than the liquid electrolyte, which would not make economic sense today,” adds Tan. “If you look at lithium-ion batteries 20 or 30 years ago, it was also orders of magnitude more expensive than what it is today, so most of us are betting that this cost of precursors in electrolytes will come down with time.”

Nissan engineers are developing all-solid-state batteries in a pouch format. Photo courtesy Nissan Motor Corp.

Nissan’s experience presents another issue, because it needs production equipment. “There are several challenges we must overcome technically for mass-production, such as production process technology to form large area layers at [high] speeds while ensuring cell uniformity, precision press and lamination technology,” says a Nissan spokesperson.

And then there’s commercial, industrial and regulatory challenges to producing commercially viable solid-state batteries. “As we look toward global production, the creation of supply chains is necessary,” the spokesperson points out. “In addition, there are regulatory and certifications to consider, especially around new material systems required with all-solid-state battery production.”

Assembling and Testing Battery Modules

The production of solid-state battery cells will affect the complexity of battery module assembly, especially when it comes to cell packaging and the attachment of cells.

“You can certainly change how you actually build [ASSB] cells,” says Argonne’s Lipson. “For instance, with a solid-state battery, you can stack the cells into one larger cell, essentially having a module in a single package. Typically, what you have are individual cells that you put together, that are packaged themselves and then you have to stack them. You get around that because the liquid electrolyte would short out the cell if you have stack them all together in one package.”

While the complexity of battery modules may decline as cell packaging decreases, another kind of complexity may emerge. “Doing that packaging-less stacking may be kind of complicated in the end, because you have to weld all those materials together somehow,” notes Lipson.

By using more than 50 percent active silicon in its anode, Solid Power engineers have increased energy density. Photo courtesy Solid Power Inc.

The effect solid-state batteries will have on the cost of assembling modules may hinge on cells and the ways that pressure is exerted on battery cell stacks. “The cost of assembling battery modules [from those ASSB cells] depends on the number of battery cells in the module,” says High Performance Battery’s Heinz.

The pressure that solid-state cells may require can also affect the cost of module assembly. For instance, it may be necessary to apply pressure to stacks of solid-state cells. According to the Fraunhofer Institute, “In contrast to liquid electrolytes, volume changes in the active material during charging and discharging cycles may affect the ionic contact between the solid electrolytes and the active material, which typically necessitates the application of external pressure to the cells.”

The presence and degree of this stack pressure, then, affects the cost of ASSB module assembly. “If you need a higher stack pressure, you’re going to need more metal, you need to have nuts and bolts, inactive materials for these systems that do not directly contribute toward energy,” notes Tan. “These inactive materials severely impact the cell-to-module-to-pack conversion efficiencies, and in turn, cost efficiencies.”

Commercially viable solid-state batteries may also affect the complexity and cost of testing battery modules.

“Potentially, you could have fewer cycles [in ASSBs] that you would need to run to do that initial testing and formation process,” says Lipson. “In a traditional battery, there’s a lot of film formation [occurring] on the surfaces of the electrodes in those first few cycles.

Solid-state batteries offer numerous advantages over lithium-ion batteries. Photo courtesy ProLogium

“It’s very critical to get that formation exactly right of those films, otherwise the battery won’t perform as well and it’ll degrade faster,” warns Lipson. “That’s a very critical step for the liquid electrolytes, but in a solid-state battery, ideally you don’t have any of those reactivities between the different materials and you should be able to avoid that kind of thing.”

According to Lipson, the interactions and boundaries of solid electrolytes may affect module testing. “You do have to worry about sealing the packaging,” he points out. “I’m not sure what testing they would do to determine that, because all the electrolytes are air-sensitive. You need to make sure that the actual battery cells themselves are well sealed.”

Hybrid solid-state batteries and ASSBs could also lead to changes in leak testing. In fact, some experts believe the process could actually become easier.

“The failure mode testing [of ASSBs] tends to be different from lithium-ion,” says Tan. The testing will differ because ASSBs tend to fail quickly, while lithium-ion fails gradually. For ASSBs, “It’s a sudden failure and it often occurs at the initial few cycles,” explains Tan, who also expects this to shorten the time it takes to perform failure mode testing on ASSB modules.

In addition, there could also be a change in the cost of testing ASSB modules. “My prediction is it should drop the cost, assuming you don’t have to do nearly as much formation cycling or you could do it faster than what’s currently done, because you have to go slow to get the kinetics right through that film formation,” notes Lipson. “You should be able to do that faster in a solid-state battery, so basically time is money on this one and the shorter time, less cost.”

The production of solid-state battery cells will affect the complexity of battery module assembly. Photo courtesy Nissan Motor Corp.

Assembling and Testing Battery Packs

Solid-state batteries may also affect the assembly of battery packs, because they tend to have a larger operating temperature range than lithium-ion batteries.

“You don’t have to integrate liquid cooling systems [into ASSBs] and you don’t have to put all these safety systems on top of it,” claims Lipson. “So, it should make things easier from that perspective.”

For instance, a decrease in cooling systems and safety systems for ASSBs may reduce the cost of assembling battery packs. And, a simpler process should mean less assembly time.

Commercially viable solid-state batteries could have an impact on the complexity and cost of testing battery packs. “Initially, I’m sure [hybrid solid-state and ASSBs] will increase the testing requirements on the packs, because it’s new technology,” notes Electrovaya’s DasGupta.

“If anything, [ASSBs] will make it easier just because of the safety issues being resolved,” adds Lipson, who believes the cost of testing will also be impacted. “It will be a reduction, because you don’t have to do as much of the safety testing [for ASSBs].

“I think that will be a relatively minor effect on the overall cost of the whole battery production process, because the tests will be the same between the two,” concludes Lipson, who expects hybrid solid-state and ASSB packs to take about the same amount of time. “So, you may be [able to] remove some of the safety testing that you do up front. But, on an individual pack, it’s going to be basically identical to the current generation.”