ROBOTICS

Austin Weber // Senior Editor // webera@bnpmedia.com

Humans and machines are collaborating on trim lines.

Beyond the Welding Line: Robots and Automotive Assembly

Austin Weber // Senior Editor // webera@bnpmedia.com

Humans and machines are collaborating on trim lines.

Beyond the Welding Line:

Robots and Automotive Assembly

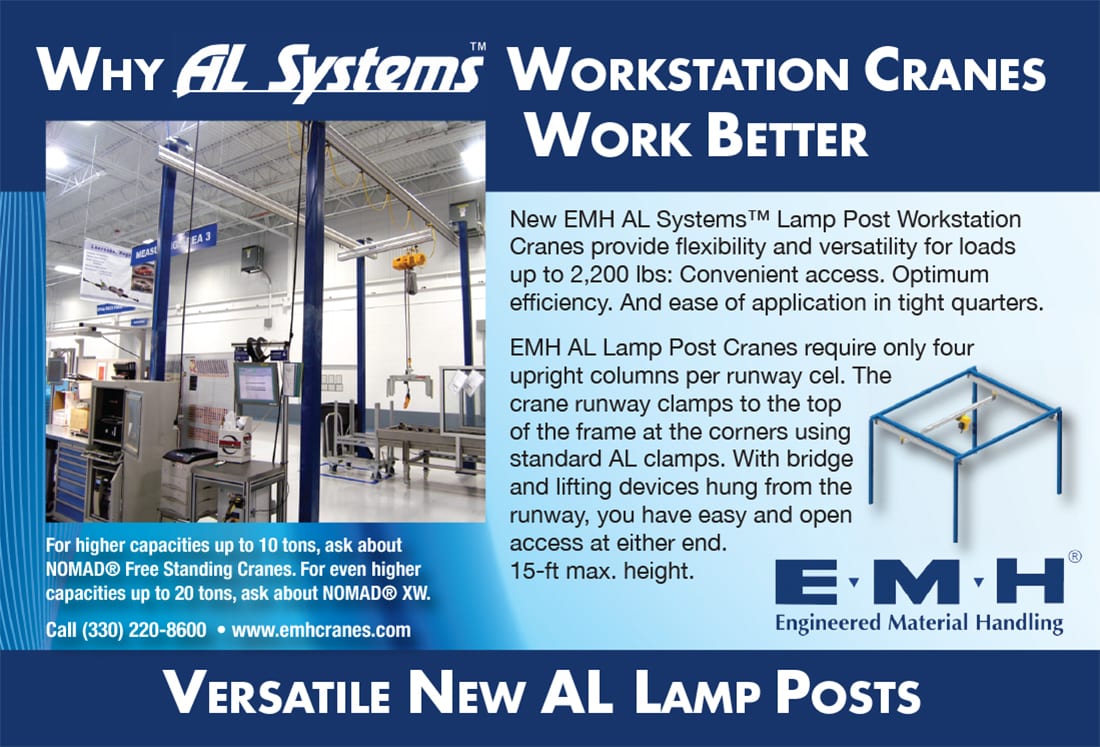

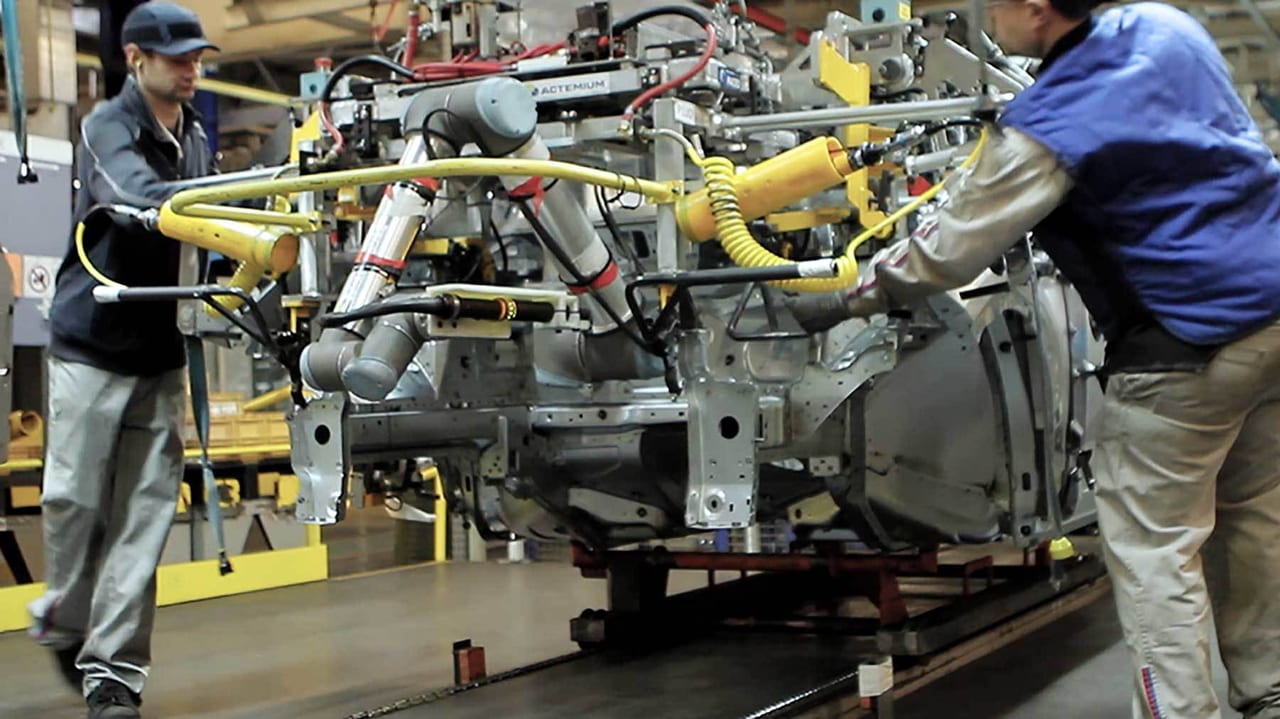

Automakers are starting to deploy robots on final assembly lines. Photo courtesy Universal Robots A/S

For decades, automakers have primarily used robots for welding and painting. Final assembly lines were considered too complex and too unsafe for automation. However, that is changing.

The growing popularity of collaborative robots is enabling automotive engineers to automate nontraditional production processes, such as trim lines. In addition, the Covid-19 pandemic, ergonomic issues and electrification efforts are spurring new robotic applications for adhesive and sealant dispensing, bin picking, part insertion, screwdriving and nutrunning, and test and inspection.

The Final Frontier

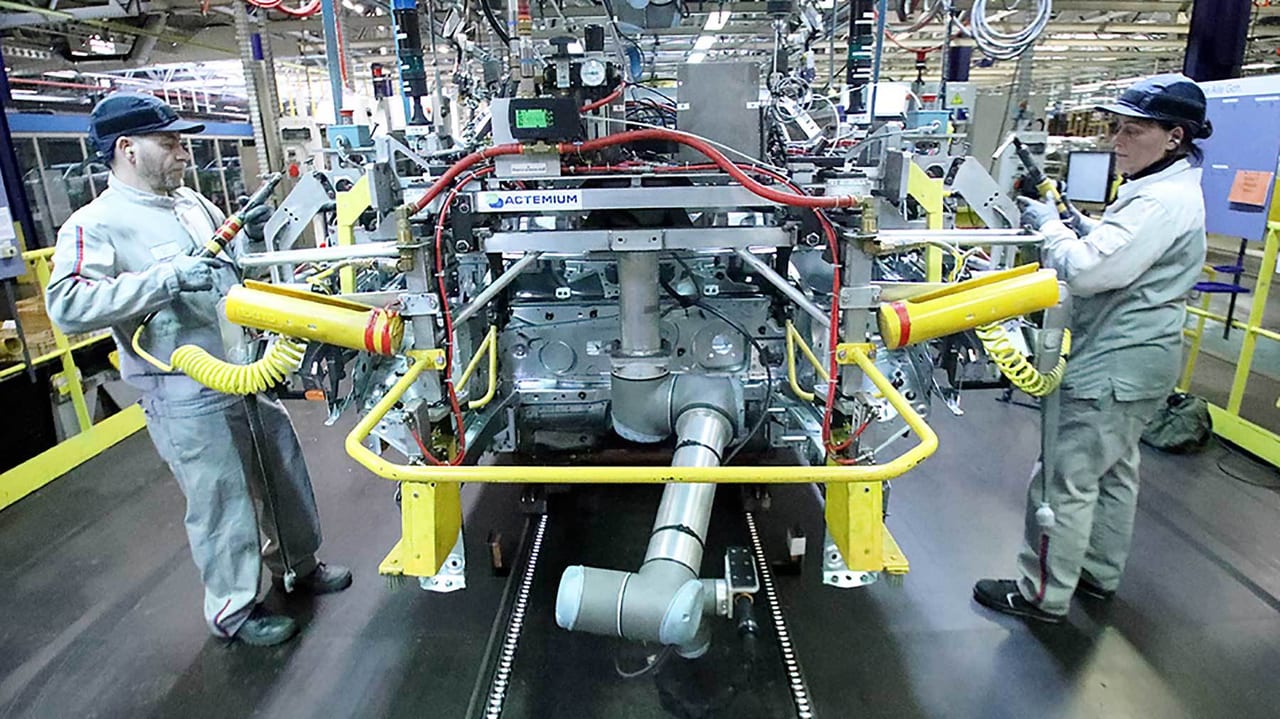

Traditionally, automotive trim lines have relied heavily on manual assembly processes. Photo courtesy General Motors

Final assembly involves complex trim lines where operators manually install a wide array of components such as carpeting, doors, instrument panels, interior lighting, infotainment systems, seats and other subassemblies. It involves a variety of just-in-time and just-in-sequence processes that must be precisely choreographed. Since most vehicles have four or five trim levels, accuracy, error proofing and process control are essential.

“Final assembly is the final frontier of automation, and advanced robotics is ideal for tackling variation and model mix,” says Max Reynolds, CEO of Symbio Robotics Inc. The Bay Area startup has been helping legacy manufacturers, such as Ford Motor Co. and Toyota Motor Corp., deploy AI-controlled six-axis robots on their assembly lines.

According to Reynolds, the “killer app” for robotics in the auto industry has always been welding. The return on investment for that application revolves around labor cost savings, increased throughput and improved quality. Symbio is focused on enabling that ROI to be applied to final assembly, which Reynolds says is currently less than 5 percent automated.

“Traditionally, final assembly has been difficult to automate because of flexibility issues and challenges,” explains Reynolds. “The main pain point associated with mechanical fixturing and stop stations has been that they are designed for specific models being produced. To launch a new platform or frame geometry, you have to rip out all of that mechanical infrastructure and start over from scratch.

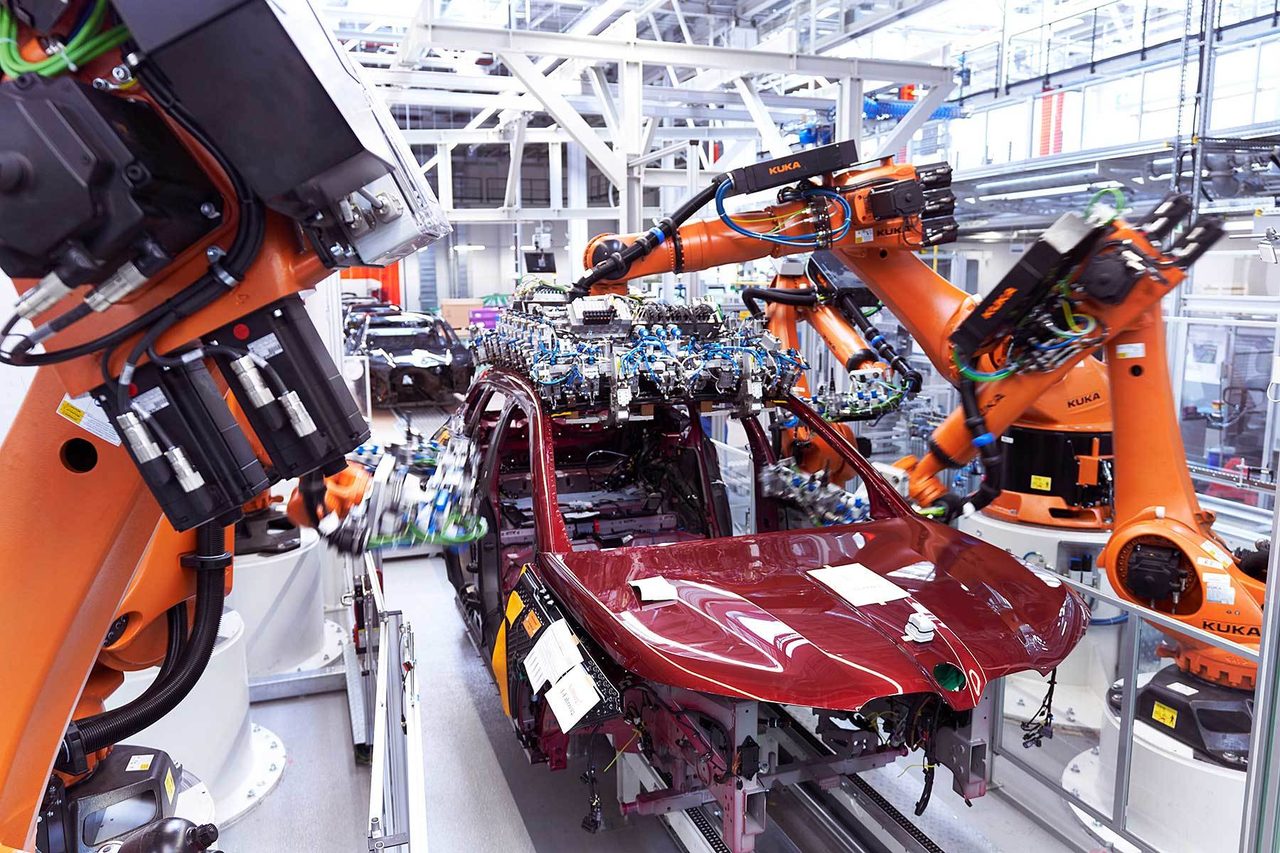

Electric vehicle assembly applications are forcing engineers to rethink how robots are used on final assembly lines. Photo courtesy Nissan Motor Co.

“We are shifting that mechanical problem solving process into software,” notes Reynolds. “SymbioDCS is a robot-agnostic platform that absorbs a lot of traditional complexity with software that can adapt automatically to new models or process variation.

“Symbio enables robotic automation to be more adaptive and nimble, and ultimately more flexible in terms of supporting variations such as design changes,” claims Reynolds. “Our focus is on using software to improve availability, performance and quality, with an emphasis on new product introduction when those metrics tend to be lowest and generate the biggest pain points.”

Reynolds says his long-term goal is to de-risk final assembly automation. “One reason why final assembly lines are only 5 percent automated is that it’s a harder problem area to solve than painting or welding applications,” he points out. “There’s a lot more variation. Design changes show up in places in final assembly that don’t show up in the body shop.”

There are also tolerance stack ups in final assembly as more components are installed in a vehicle. In addition, many of the assembly tasks require a large degree of dexterity.

“While there are some robots in use on final assembly lines, the main thing that has held back automation is that many systems integrators view it as too risky and a hard problem to tackle,” explains Reynolds. “To address that issue, we’re developing a set of technologies in a software program that enables integrators to deploy automation in those environments with more confidence.”

“Final assembly has always been a largely manual process, with operators carefully controlling quality, adjusting minor misalignments, tightening screws and other artisan-like details,” adds Volker Buchbauer, mobility segment leader at Comau, which supplies robots to a variety of automakers, ranging from legacy OEMs such as Stellantis to startups such as Mullen. “Until now, robots were not sophisticated enough to handle the uncertainties in many of the required tasks.

“There was also the issue of safety hazards, which meant that the robot cell and its fences essentially interrupt the linear flow of the line,” says Buchbauer. “Now, with the help of artificial intelligence and advanced vision systems, robots are able to perceive the world around them and adeptly handle the precision and variables within the final assembly process.

“More importantly, intelligent robotics allow automakers to leverage the ideas, energy and value-add of human operators, while experiencing higher productivity, better quality and lower overall costs,” explains Buchbauer.

For example, Comau has developed a robust, yet flexible system that automates the traditionally manual gap and flush measurement process. Using a Racer-5 collaborative robot and an integrated EDIXIA vision system, the technology automatically identifies nonconforming gap and flush alignments with positioning repeatability on the measuring point of just a few tenths of a millimeter compared to more than 1 millimeter with a manual system.

At full speed, the system is capable of controlling more than 50 points on a moving vehicle at a rate of up to 60 jobs per hour.

Flexibly Focused

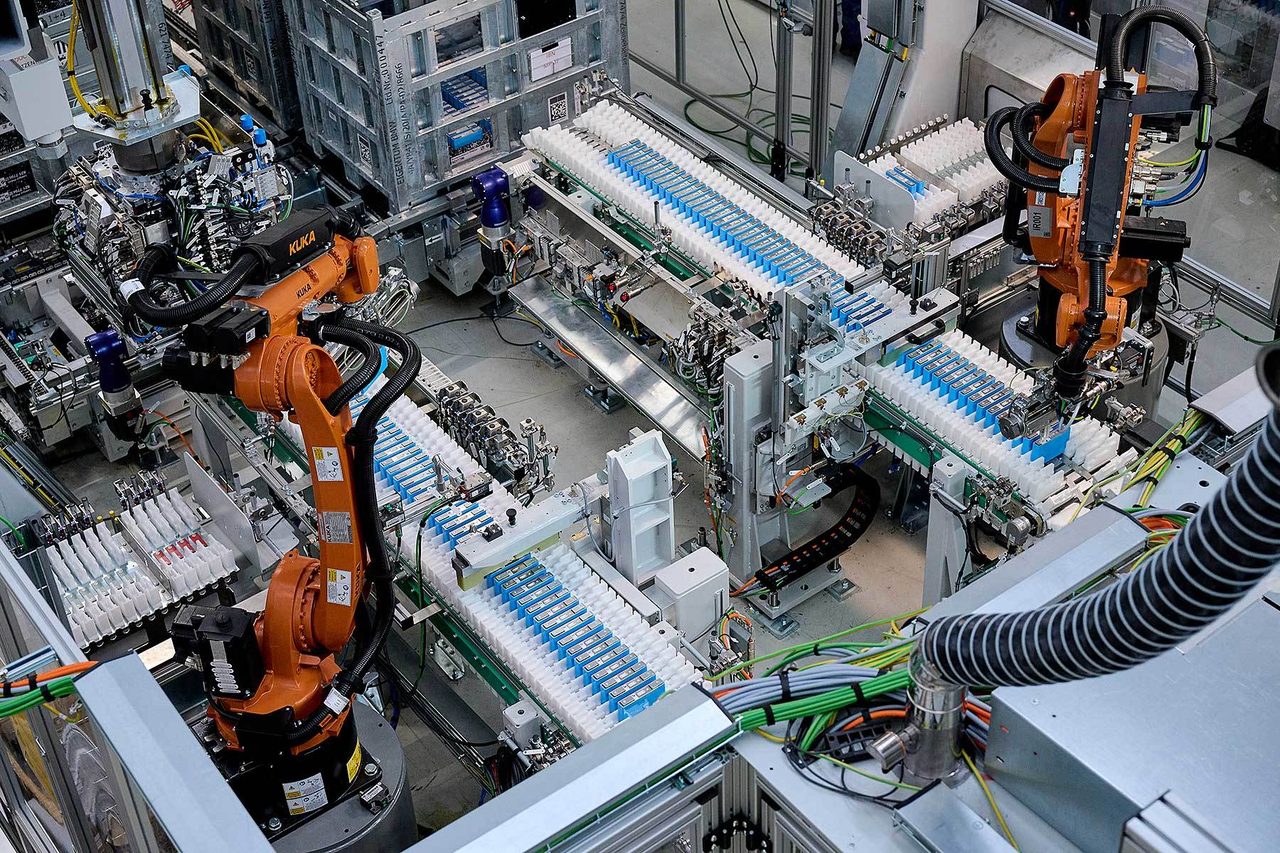

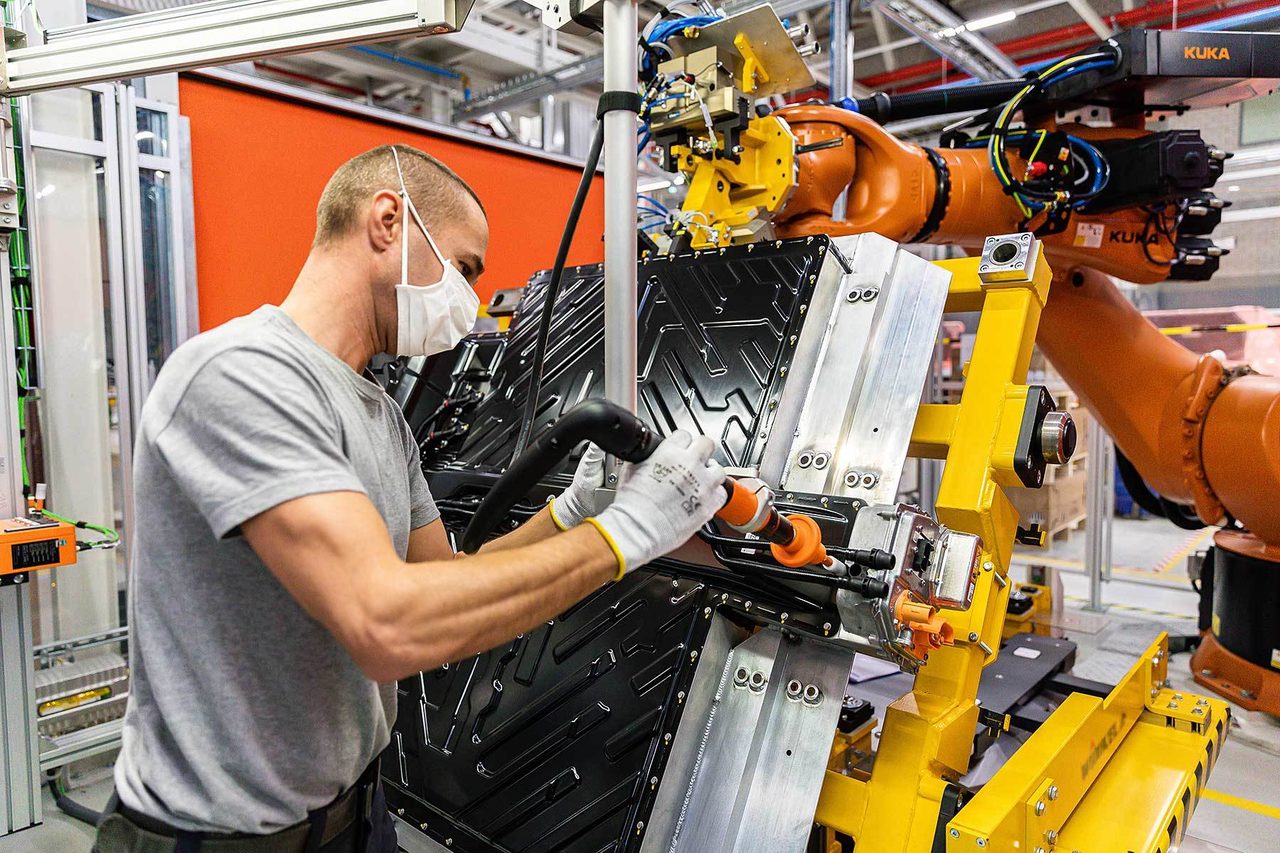

Robots are ideal for assembling battery modules and battery packs. Photo courtesy BMW AG

In today’s competitive, fast-paced auto industry, product life cycles are getting shorter and product changes are quicker than ever. That’s driving demand for greater flexibility on final assembly lines.

“There have been two big changes over the last few decades,” says Neil Dueweke, vice president of automotive and new mobility at Fanuc America Corp. “Time to market has become more compressed, because of the competitiveness of the EV race. Today, time is the most valued commodity—often, even more important than price—due to market pressures. Automakers no longer have prolonged product development cycles like in the old days.

“The other big change is the ‘risk factor’ associated with automation,” explains Dueweke. “In the past, everyone was worried about the return on investment associated with robots. However, the Covid pandemic and widespread labor shortages have changed that scenario. Today, people are considered to be the primary process variable in assembly line planning. Many manufacturers now see automation as a way to mitigate that risk.

For decades, automakers have primarily used robots for welding and painting applications. Photo courtesy General Motors

“Visual line tracking, an interesting trend that’s just starting to evolve, will make assembly lines more flexible in the future,” claims Dueweke. “This technology enables smart robots to process microsecond information on the location of a particular part on a vehicle that’s on a moving assembly line. The robot can do more than just place a component in a vehicle. It enables robots to make adjustments on the fly to facilitate variation in assembly operations.

“We’ve tested visual line tracking in our own factory,” notes Dueweke. “We expect to see several commercial applications in the next 12 to 18 months. This breakthrough will enable more automation to be used in final assembly.”

“Today, we see much shorter time to market and product life cycles that are compressed,” adds Symbio Robotics’ Reynolds. “Vehicle life cycles that once were five to seven years are now three years or less. That’s being driven by new startups, such as Rivian and Tesla, that are coming to market quickly and putting a lot of pressure on incumbents such as Ford, General Motors and Toyota.

This new robot was designed to handle heavy payloads, such as EV battery packs. Photo courtesy Fanuc America Corp.

“In the future, flexible manufacturing will continue to be extremely important in the auto industry as the transition to EV production intensifies,” predicts Reynolds. “Ten years ago, the approach to launching a new product was to build an assembly line with a custom set of tooling. However, today, with a flexible, software-defined approach, you mitigate risk.”

“Flexibility helps automakers better manage variables and market uncertainty, which is why our customers are demanding modular solutions that can handle multiple models in random mix production,” says Comau’s Buchbauer. “Scalability is a secondary requirement, as it helps protect the capital investment and can reduce the time and costs associated with introducing new models in the future.

"In tandem, automakers are also unifying and retooling existing lines to accommodate new and sometimes radically different models,” explains Buchbauer. “We have worked on projects where a line produces traditional vehicles in random mix with hybrid and electric cars, or where a compact car is built on the same line as an SUV.”

Another big challenge for automakers is the increasingly aggressive time-to-market objectives. To address that issue, Comau and other suppliers are designing flexible production fixtures and platforms that allow engineers to anticipate evolving market and model demands.

“This drastically reduces the time needed to introduce a new vehicle to the tune of nine to 12 months compared to the previous average of 18 to 24 months,” says Buchbauer. “And, as the complexity of automation increases, so does the sophistication of the technology that surrounds it. Even the robots are becoming more flexible, with the newest generation of intelligent robotics able to interpret variable data inputs and perform nonsequential actions that respond in real-time to the environment around them.”

Collaborative Assembly

Collaborative robots enable humans and machines to work in close proximity on automotive assembly lines. Photo courtesy Universal Robots A/S

Traditionally, automotive assembly plants have been the realm of large, articulated , six-axis robots that perform a wide variety of welding and painting applications. But, that’s changing with the growing popularity of collaborative machines that enable humans and machines to safely work in close proximity.

“The traditional approach to automation has been all or nothing, with big robots and big safety guarding,” says Joe Campbell, senior manager of strategic marketing and applications development at Universal Robots A/S (UR). “That has been a constant struggle for decades. Engineers could use automation for most of their assembly tasks, except for the last 10 percent.

“We’re starting to see cobots deployed to address ergonomic issues in final assembly applications,” explains Campbell, who cites several recent examples in Europe at Stellantis factories. In particular, the company’s UR10 machine, which boasts a payload capacity of 27.5 pounds, is popular for screwdriving applications.

Six-axis robots automatically install headliners at Nissan’s flagship Tochigi plant in Japan. Photo courtesy Nissan Motor Co.

“Operators often have to bend over to accomplish some low-level assembly tasks, such as inserting and driving screws that hold mud flaps and wheel well liners,” Campbell points out. “Because cobots can work in close proximity to humans, workstations don’t have to be fenced off and totally guarded like in the past. Operators can work side by side with cobots. Humans can focus on tasks that are easily accessible, while the machines work on things that are more difficult to reach.

“Today, we’re seeing a lot of interest in using cobots to supplement line workers,” says Campbell. “Final assembly has some of the most demanding processes and the most operator engagement. Operators on an automotive assembly line move like they’re in a ballet. Their movements are accurately choreographed and have a precise rhythm.

“However, some tasks cause more challenges, due to ergonomics,” notes Campbell. “Because collaborative robots can help operators avoid constantly bending over or reaching awkwardly with heavy tools, I expect to see a lot more of them used on final assembly lines in the next 10 years.”

Screwdriving cobots and human operators work in close proximity on this PSA Group assembly line in France. Photo courtesy Universal Robots A/S

“There are multiple manual and semiautomated processes during the final assembly phase in which humans and cobots can work side by side,” adds Comau’s Buchbauer. “Indeed, the human element is an important value-add for automotive manufacturing, as trained operators leverage their experience, intelligence and decision-making logic to ensure optimal outcomes. At the same time, the repeatability of the cobot leads to increased efficiency, reduced quality errors and a lower cost of failure compared to a purely manual process.

“The new generation of collaborative robots is definitely a game changer, both because they eliminate the need for safety fences and incorporate the agility to perform intelligent operations,” says Buchbauer. “Gap and flush inspection is a good example. As a manual process, it can be costly and time-consuming.

“We’ve automated it by creating an in-line measurement [system] using collaborative robots that can accurately and automatically assess up to 60 vehicles per hour while moving along the final assembly conveyor,” explains Buchbauer. “On the opposite end of the scale, we have the Aura robot which, with its 2.8-meter reach and 170-kilogram payload, is the largest collaborative [machine] on the market. It is being used to perform final assembly calibration on vehicles as the worker sits safely in the driver’s seat.”

According to Buchbauer, the integration of robots and neural networks is another game changer. “Through the use of meta-language programming logic, for example, we can now teach the robot using simple, human commands,” he points out.

“We’ve recently developed a humanized robotic test bench using a cobot that is able to see the screen, execute operations and respond to image, text and voice inputs,” says Buchbauer. “The simplified programming interface also allows the operator to quickly adapt, adjust and correct the actions of the robot in real time, optimizing work cycle efficiency.”

The Electric Age

More electric vehicles will be soon be assembled with robots. Photo courtesy BMW AG

Automakers and suppliers are investing billions of dollars to develop a wide variety of electric vehicles. That’s forcing legacy manufacturers to take two different production approaches.

Some are planning to have specific plants dedicated to producing EVs. For instance, GM has designated five plants in North America: Factory ZERO in Detroit, Orion Assembly in Michigan, Spring Hill Assembly in Tennessee, CAMI in Canada and Ramos Arizpe Assembly in Mexico.

On the other hand, OEMs such as Ford, Nissan, Stellantis and Toyota have decided that it’s too early to put all of their chips on the electric side, so they will operate flexible plants that can assemble a combination of EV and gas-powered vehicles.

Both production strategies affect product design, manufacturing complexity and cost. There’s also a big difference in the way that legacy automakers and startups approach automation and robotics.

According to Symbio Robotics’ Reynolds, start-ups have a big advantage over legacy companies, because they’re not stuck in the same way of thinking about how the industry has traditionally done things. “They have a lot more leeway to experiment and challenge the status quo,” he points out. “That’s why you see them moving quickly when it comes to product development and new vehicle launches.

Scenes like this may become more common in automotive assembly plants in the near future. Photo courtesy Universal Robots A/S

“The big advantage that traditional automakers have is economy of scale,” says Reynolds. “They have a much larger production footprint, which lead to advantages in terms of cost. However, they still need to figure out how to launch new products more quickly to compete with fast-moving competitors.”

“The automotive industry has always been at the forefront of automation,” notes Joerg Reger, managing director of the automotive business line at ABB Robotics. “But, with the shift to electrification, it faces wholesale changes to established manufacturing processes.”

At one of several different EV projects it’s currently involved with, ABB is supplying robots for a new highly automated battery assembly plant in Sweden that is due to open next year.

“This will mark the first time [our] IRB 390 robot will be used in a battery production facility,” claims Reger. “Originally designed for the packing industry, the delta robot combines speed with power and can mount contact plates in batteries at a rate of one plate every second, 24 hours a day.”

This robot is holding a heavy, bulky battery pack while an operator performs a manual screwdriving task. Photo courtesy Daimler AG

“The whole EV sector has exploded in the last 18 months,” adds Fanuc’s Dueweke. “There are many robotic applications for assembling battery modules and battery enclosures. In fact, depending on line speed, there can be a need for between 100 and 200 robots for each application.

“We’re seeing an increased demand for SCARA robots, especially for battery module assembly,” explains Dueweke. “Speed, repeatability and small footprint are some of the advantages of using SCARAs for applications that include dispensing, screwdriving and material handling. Our SR-20iA robot, which has a payload capacity of 20 kilograms, has proven to be popular for working with evolving battery designs.

“For battery enclosures, we see demand for large six-axis robots that can carry a variety of payloads ranging from 10 kilograms up to more than 1,000 kilograms,” says Dueweke. “Our R-2000 series has become the workhorse for many battery tray assembly applications, because it can handle payloads between 100 and 270 kilograms. Applications include laser welding, dissimilar metal welding, riveting and sealant dispensing.”

To meet increased demand, Fanuc recently launched a new robot that can accommodate heavy loads for applications such as processing and handling battery packs.

The M-1000iA features serial-link construction that gives it a wider range of motion in every direction. The machine can extend its arm upright or rotate it backwards, which is not possible for typical heavy-payload robots with a parallel-link mechanism. The robot can handle payloads up to 1,000 kilograms, with a 3,253-millimeter horizontal reach and a 4,297-millimeter vertical reach.