capital spending outlook

capital spending survey

John Sprovieri // Editor In Chief

With the pandemic subsiding and consumer spending on the rise, manufacturers are investing in their assembly operations.

Assemblers Gear Up

for Recovery

John Sprovieri // Editor In Chief

text

Assemblers Gear Up for Recovery

In February 2020, U.S. manufacturers employed nearly 12.8 million people. Then came the COVID-19 pandemic. In an instant, the country lost 1 million manufacturing jobs as governments and businesses scrambled to figure out how best to stop the spread of the disease.

Alas, the pandemic is still with us, but the outlook is brighter. Some 59 percent of the U.S. population is fully vaccinated against the virus. As of Nov. 15, the seven-day moving average of new deaths from COVID was 1,110. That’s nearly a third of the average at the pandemic’s peak—3,645 on Jan. 13, 2021—but it’s still more than seven times the average at the pandemic’s low point, 144 on July 11, 2021.

Be that as it may, U.S. manufacturers are back to work and producing again. Through October, the U.S. manufacturing sector employed more than 12.5 million people. That’s a gain of more than 1.1 million jobs since the low point of the pandemic, and it’s just 2 percent shy of the February 2020 total. What’s more, manufacturing employment is poised to increase even more—if workers can be found. The Bureau of Labor Statistics recently released its Job Openings and Labor Turnover Survey for September, and it shows a persistent gap between open manufacturing positions and available skilled workers—even amid a pandemic. According to the survey, U.S. manufacturers had 897,000 job openings in September. That compares with 869,000 in August and 500,000 in September 2020.

Pandemic or not, U.S. manufacturers are continuing to invest in people, plants and equipment. Consider the latest data from AMT—The Association for Manufacturing Technology. New orders for metal cutting, forming and fabricating equipment in the U.S. totaled $590 million in September 2021. This is a 9 percent increase over August 2021 orders and nearly a 60 percent increase over September 2020.

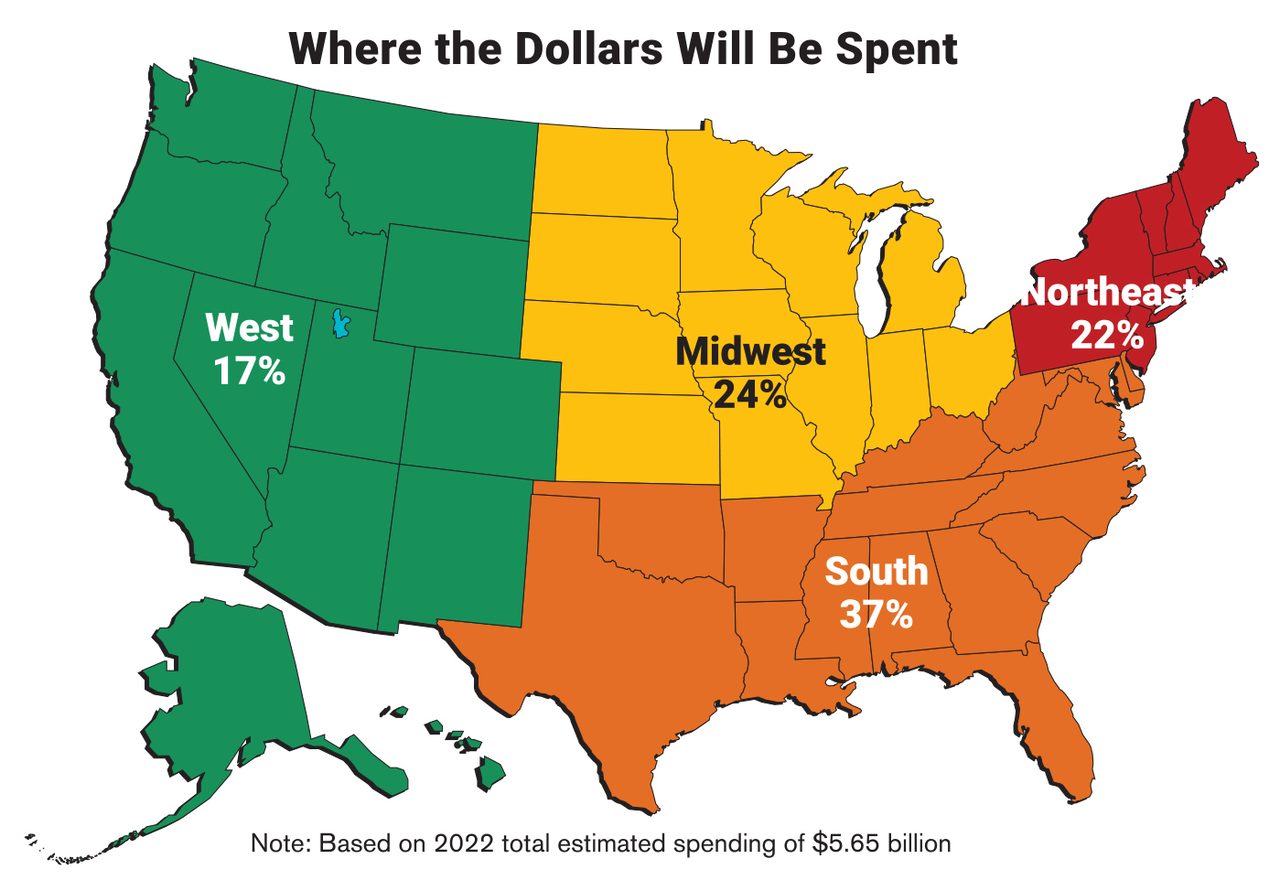

For only the second time in survey history, the South will account for the majority of spending on assembly technology.

Machinery manufacturers will spend, on average, $2.7 million on assembly technology in 2022, twice the average from 2021. Photo courtesy Deere & Co.

New orders for the first nine months of the year amount to more than $4.1 billion, a 53 percent increase from the same period last year.

Manufacturers in every industry are investing in their operations. For example, in September, GE Appliances opened a new refrigerator assembly line at its manufacturing complex in Louisville, KY, part of a $60 million investment in the facility. More than 245 new manufacturing jobs have been added to support the new line. Just a month earlier, the company announced that it is investing $5 million to assemble air conditioners at its factory in Selmer, TN. The company had been assembling the units in Mexico, but decided to reshore production to be closer to U.S. customers. The new investment will create a fifth assembly line at the plant and add 33 new jobs, bringing total employment to 465.

Automotive assemblers are investing, too. For example, South Korean auto parts supplier Sungwoo Hitech America Corp. recently announced that it will invest $40 million to buy and equip an existing 380,000-square-foot factory building in Telford, TN. The assembly plant will be the company’s first U.S. facility, which is expected to employ 206 people by 2027.

The pandemic has hurt smaller manufacturers more than larger ones. Next year, companies with more than 250 employees will account for more than three-fourths all spending, while companies with less than 100 workers will represent just 5 percent.

For the fifth straight year, assemblers of products smaller than a 12-inch cube will represent the lion’s share of total spending next year.

Appliance assemblers will account for just 3 percent of total spending next year. That’s the lowest share for this industry in survey history.

Even in aerospace manufacturing—an industry decimated by the pandemic—companies are investing. For example, Roll-Royce just completed a six-year, $600 million modernization of its manufacturing campus in Indianapolis. The revitalized campus is now highly efficient and will improve competitiveness in an increasingly contested marketplace for aircraft propulsion and power equipment. The energy efficiency of the buildings has also been improved significantly and will help Rolls-Royce achieve its goal of net-zero carbon emissions in operations by 2030.

Will investments like that continue into 2021? The results of our 26th annual Capital Equipment Spending Survey point to a significant increase in investments next year.

Significant Growth Ahead

Some 43 percent of respondents will spend more on assembly technology next year than they did this year. That compares with 32 percent in last year’s survey, and it’s the fourth time in the past five years in which that figure has topped 40 percent.

Conversely, just 16 percent of respondents will spend less in 2022 than they did 2021. Last year, that ratio was 24 percent.

Forty-one percent will spend the same in 2022 as they did in 2021.

Of those plants that will spend more, the average budget increase is 25 percent. Of those that plan to spend less, the average budget decrease is 35 percent.

On average, manufacturers will spend $1,910,890 on assembly technology in 2022. That compares with $860,329 in 2021, and it’s the highest average in survey history. The median budget total is $220,000. That compares with $150,000 in 2021, and it, too, is a record high.

“The global pandemic has caused significant problems to the supply chain, causing nearly all manufacturers in almost every industry some kind of delays or issues in getting parts and components,” points out Rick Brookshire, director of product management and development at Epson Robots. “However, this has helped to drive the need for automation higher than we have seen in quite a few years. 2021 was a great year for Epson Robots, as we helped both experienced automation users and many new robot users automate their factories. We fully expect 2022 to be even better.”

Aggregate budget data indicate major growth in spending. For example, 45 percent of plants have capital budgets of at least $500,000 in 2022. That compares with 30 percent in 2021, and it’s a record high for our survey. At the same time, only 31 percent will spend less than $100,000 on assembly technology in 2022, which is a record low. Similarly, only 24 percent will spend between $100,000 and $499,999, down from 31 percent in 2021.

Automotive Leads the Way

Looking at spending plans by industry, it’s clear the automotive industry is leading the way in capital investment, prompted by the looming transition from gas-powered vehicles to electric ones. Some 62 percent of assemblers in auto industry will spend more in 2022 than they did in 2021, the highest percentage of any industry. Of those auto plants that will spend more next year, the average budgetary increase is a whopping 33 percent. That, too, is more than any other industry.

On average, automotive assemblers will spend $1,290,045 on capital equipment next year, up from $694,400 in 2021.

Those figures should not be surprising. Automotive OEMs across the U.S. and worldwide announced major investments throughout 2021.

Just consider Toyota Motor Corp., for example. In October, Toyota announced plans to invest $3.4 billion in the United States over the next decade support electric vehicle production. The initiative will include construction of a new battery factory that will start production in 2025. Also this year, the carmaker revealed plans to:

invest $460.8 million to expand its flagship assembly plant in Georgetown, KY, already the company’s largest in the world.

invest $803 million to produce two new electric vehicle models at its assembly plant in Princeton, IN. The project is expected to create approximately 1,400 new jobs by the end of 2023.

invest $210 million to upgrade its assembly plant in Buffalo, WV. The project is expected to increase the plant’s capacity and create 100 new jobs.

Some 45 percent of plants will spend at least $500,000 on assembly technology next year—a record high.

Will Aerospace Remain Grounded?

Perhaps no other industry has been hit harder by the COVID-19 pandemic than the aerospace industry, and that is reflected in our data. Just 33 percent of aerospace assemblers expect to spend more in 2022 than they did in 2021, while 25 percent plan to spend less. The former is the least of any industry; the latter is the most.

On the other hand, actual budget figures suggest that spending in the industry may not be too bad. Aerospace assemblers will spend, on average, $3.1 million next year on new equipment, a significant boost from the 2021 average of $732,000.

Better still, people are flying again. Monthly passenger traffic is still down 27 percent from the all-time high of 79.8 million air travelers in January 2020, but it’s getting there. Some 58.4 million people boarded passenger jets in September 2021—more than double the number of people who flew in September 2020.

Thankfully, aerospace OEMs and their suppliers seem to have weathered the storm, and have taken a long-term view on manufacturing investments. For example, in October, Boeing announced that it will invest $200 million to build a new plant in Mascoutah, IL, to assemble drones for the U.S. Navy. The project is expected to create 300 jobs. And, in June, GE Aviation began construction of a new assembly plant in Beavercreek, OH, that will make components for jet engines.

Small Companies Feel Pinch

Looking at spending plans by company size, our data indicate that spending will increase across the board. However, it’s also clear that smaller companies continue to feel the impact of the COVID-related economic downturn. Some 51 percent of companies with more than 250 employees will spend more next year than they did this year, while just 13 percent will spend less. Conversely, only 35 percent of companies with up to 100 employees will spend more in 2022 than they did in 2021, while 20 percent will spend less.

Looking at actual budget figures, companies with more than 250 employees will spend, on average, $3,093,904 on assembly technology next year—twice the average from 2021. Conversely, the budget for companies with fewer than 25 employees will increase from $102,520 to $137,169 in 2022, while the budget for companies with 26 to 100 employees will increase from $299,800 to $438,786.

As a group, companies with more than 250 employees will account for 78 percent of total spending on assembly technology next year, compared with 74 percent in 2021. But, companies with up to 100 employees will represent just 5 percent of spending in 2022, compared with 9 percent in 2021.

Some 43 percent of respondents will spend more on assembly technology next year than they did this year. It’s the fourth time in the past five years in which that figure has topped 40 percent.

More Spending in the South

In September, Ford Motor Co. announced that it will spend more than $11 billion to create two huge new electric vehicle manufacturing complexes in Kentucky and Tennessee. That might be the largest investment announcement in the South this year, but it was hardly the only one. Here are just a handful:

That sort of investment is reflected in our survey data. For only the second time in survey history, the South will account for the majority of spending on assembly technology. Southern assemblers will represent 37 percent of total spending in 2022, up from 30 percent in 2021. The Midwest, traditionally the epicenter of manufacturing, will account for just 24 percent of spending in 2022. That compares with 36 percent in 2021 and it’s the lowest percentage for the region in survey history.

Fifty-three percent of plants in the South say they’ll spend more in 2022 than they did in 2021, the most of any region.

That sentiment is clearly seen in actual budgets. The average capital budget has increased in every region, but the biggest increases are in the South. On average, Southern assemblers will spend $3,110,190 on assembly technology next year, up substantially from $988,203 in 2021.

ZF Transmission is investing $200 million in its assembly plant in Gray Court, SC, creating approximately 500 new jobs.

KB Autosys, a manufacturer of brake pads, will invest $38 million to build its first U.S. assembly plant in Lone Oak, GA, creating 180 jobs.

Tier 1 automotive supplier Martinrea International Inc. is investing $40 million to expand its assembly plant in Springfield, TN. The project is expected to create 97 new jobs

Automotive supplier Faurecia will spend $18 million and add 171 jobs at its assembly plant in Spring Hill, TN.

Robots Rule

Industrial robots continue to be deployed at a record pace. According to the International Federation of Robotics (IFR), 3 million machines are now in use in factories around the world, an increase of 10 percent over 2020.

The IFR claims that sales of new robots grew slightly at 0.5 percent, despite the global coronavirus pandemic, with 384,000 units shipped globally in 2020. It’s the third most successful year in history for the robotics industry, following 2018 and 2017.

“The economies in North America, Asia and Europe did not experience their COVID-19 low point at the same time,” says Milton Guerry, president of IFR. “Order intake and production in the Chinese manufacturing industry began surging in the second quarter of 2020. The North American economy started to recover in the second half of 2020, and Europe followed suit a little later.

“Global robot installations are expected to rebound strongly and grow by 13 percent to 435,000 units in 2021, thus exceeding the record level achieved in 2018,” reports Guerry, who also serves as president of Schunk Inc. “Installations in North America are expected to increase by 17 percent to almost 43,000 units.”

According to Guerry, Asia remains the world’s largest market for industrial robots, where 71 percent of all newly deployed robots in 2020 were installed. Installations for the region’s largest adopter, China, grew strongly by 20 percent with 168,400 units shipped. This is the highest value ever recorded for a single country.

The United States is the largest industrial robot user in the Americas, with a share of 79 percent of the region’s total installations, followed by Mexico and Canada.

The IFR says that overall expectations for the North American market are very positive. A strong recovery is currently in progress and the return to pre-crisis levels of industrial robot installations can be expected for 2021, with installations expected to grow by 17 percent.

That forecast is echoed by the results of ASSEMBLY’s survey. We expect sales of six-axis robots, SCARAs, grippers and other robotic technology to increase 20 percent, from $500 million in 2021 to $600 million in 2022.

U.S. assembly plants will spend $5.65 billion on new equipment in 2022.

Thirty-seven percent of plants will purchase robots next year, a record high. Demand for robots should be particularly strong in the medical, automotive, aerospace and fabricated metal products sectors.

“In September 2020, our manufacturing customers saw a great need for our robotic tooling. Sales grew 30 percent,” says Bob Little, president and general manager of ATI Industrial Automation, a supplier of tool changers, compliance devices and other robotic peripherals. “Our customers predict strong growth for 2022—possibly as much as 30 percent—but the supply chain has constrained them. The supply chain is causing a reduction in growth.”

“As a result of the pandemic, Epson is seeing many new robot users implement outstanding automation solutions,” adds Epson’s Brookshire. “Much of this is being achieved due to how much easier robots are to use today vs. just five or 10 years ago. The industry continues to do a good job of making better products that are easier to use at an incredible price point. As a result, many smaller companies are now automating their factories and keeping manufacturing local or reshoring.”

A driving force behind the spike in demand for robots is the growing popularity of collaborative robots. One-third of assemblers are currently using the technology or plan to within the next year. An additional 21 percent expect to employ cobots within two to three years.

At the 9th annual Assembly Show in October, at least nine exhibitors displayed cobots or cobot accessories. One of those exhibitors—Universal Robots—just announced that it tallied sales of $78 million in the third quarter of 2021, an increase of 46 percent from the third quarter of 2020 and 31 percent from the third quarter of 2019, before the pandemic.

“The labor crisis in manufacturing shows no signs of slowing down—in fact it appears to be expanding,” says Joe Campbell, senior manager for strategic marketing and application development at Universal. “Plant managers, CEOs and owners alike are aggressively investing in cobot automation to fill the gap. It’s no longer a question of reducing labor costs. The investment debate has transitioned to one of overall plant and machine utilization, production capacity and the ability to fulfill key customer orders.”

Keep it Moving

Another technology that should see an uptick in sales next year is conveyors and material handling equipment. Some 37 percent of assembly plants will invest in conveyors next year. That compares with 33 percent in 2021, and it’s the second highest percentage in the history of our survey.

“2021 proved to be a year of unprecedented growth for mk North America, ranging from conveyor sales, to facility expansion and new product line releases,” says Scott Blais Jr., inside sales manager at mk North America Inc. “With an approximate 32 percent increase in conveyor sales and an approximate 28 percent increase in total quoting volume from the 2020 mark, mk has grown its existing and new customer bases tremendously over the 2021 calendar year, and we look to continue this growth as we sprint towards 2022.”

Demand for conveyors will be particularly strong in the automotive and electronics industries. All totaled, sales of conveyors will increase 34 percent, from $97 million in 2021 to $130 million in 2022.

“We have continued to see very strong demand in 2021 and expect a strong 2022,” says Kevin Mauger, president of Glide-Line LLC. “The project opportunities and notifications have been particularly strong the fourth quarter of 2021, leading us to believe that 2022 will start off very strong. The needle is pointing straight up for assembly automation in North America, and we are glad to be part of this strong growth market.”

Some 62 percent of automotive assemblers will spend more next year than they did this year. That compares with 43 percent for the nation as a whole, and it’s the highest percentage of any industry. Photo courtesy DENSO Corp.

Single-Station Machines

Robots aren’t the only way assemblers can boost output from a limited workforce. Assemblers can also automate individual tasks like screwdriving, pressing and riveting.

Indeed, 51 percent of assemblers will invest in single-station assembly machines next year. That compares with 49 percent in 2021, and it’s the highest percentage since 2011. Demand for single-station machines will be highest in the electronics and fabricated metal products industries.

Specifically, 14 percent of plants will buy riveters, 33 percent will buy presses, and 31 percent will buy automatic screwdriving systems. The latter is the most since 2019.

“Our 2021 was strong,” says Glenn Nausley, president of Promess Inc., a supplier of servo presses and other technology. “We surpassed our forecast for 2021, and we are entering the new year with the strongest sales pipeline we have ever had. Barring a major economic downturn, we are expecting a strong 2022. A prediction of 20 percent growth in overall spending sounds about right.”

All totaled, assemblers will spend $956.3 million on single-station assembly machines next year, a 37 percent increase from 2021.

Assemblers had plenty of capacity during the height of the pandemic. Now, with the economy recovering, assemblers are ramping up production. Some 56 percent of plants will buy equipment next year to increase output. That compares with 43 percent in 2021, and it’s the second highest percentage since 2000.

Software Sales Soar

For the fourth consecutive year, computers and software are the No. 1 item on the shopping lists of assembly plants nationwide. Some 59 percent of assemblers will purchase manufacturing execution systems, enterprise resource planning systems, CAD software and other information technology products next year, up from 52 percent in 2021. Demand will be particularly strong in the machinery, medical device, and electronics industries.

“In my experience, customers obviously struggled during the early stages of the pandemic, but as things progressed and demand soared, they rapidly returned to business and began expanding purchases of software. They were dealing with how to continue to produce quality parts with labor turnover and shortage,” says Adam Dickson, strategic account manager at Tutelar Technologies Inc. “Additionally, many companies began to reshore projects because the weaknesses of a global supply chain were exposed, which meant launching new assembly lines or incorporating additional models into their existing lines.

“Our intelligent controls software helped solve those challenges, and customers could lean on our company to turnkey the implementation and take a lot of that burden off of their engineers who were stretched thin and working harder than ever,” he continues.

“Demand is now incredibly high, but companies are still trying to catch up and spending is still tight. So it is important that software address an immediate need and provide a rapid ROI,” he adds. “We expect a great 2022 as the supply chain rebounds and labor becomes more steady. Our software will continue to help manufacturers address those needs and provide a platform for continuous improvement and Industry 4.0 capability.”

All totaled, assemblers will spend $542.2 million on computers and software in 2022, a 44 percent increase from 2021.

For the fourth time in five years, replacing old or worn-out machines is the No. 1 reason for buying new equipment. Some 56 percent of plants—a record high—plan to do so next year.

“This year, we have seen a significant uptick in manufacturing-related software purchases, and we expect that momentum to continue into 2022,” predicts Deb Geiger, vice president for global marketing at Aegis Software Corp. “A multitude of disruptions marks today’s manufacturing industry. These disruptions have had serious operational and financial ramifications for many manufacturers—both positive and negative. They have forced manufacturers to rethink risk management and contingency plans, safety protocols, operations and new ways of working, all at the same time.

“They also need to future-proof the business as much as possible using the latest technology. Typically, manufacturers have a mix of different systems that were either acquired or custom-developed over the years to address specific challenges at that point in time—often purchased by different departments,” she continues. “As more and more systems entered the production environment, the more complex and expensive it became to get to a single source of truth and a holistic picture of their operations, both at the site level and across locations. We see many manufacturers seeking to consolidate and standardize their IT systems to streamline and scale processes but, more importantly, to achieve the real-time visibility and actionable insights required for continuous improvement, resiliency and adaptability.”

“Prior to COVID, most manufacturers seemed to prioritize robotic projects above software projects,” adds Ben Marsh, president and CEO of Scout Systems Inc. “With the modern logistical challenges and labor shortages, we have seen this prioritization flip. Manufacturers are discovering that with software, they can rapidly train new employees, reduce production waste and improve the efficiency of their organization.”

Certainly, in today’s factories, software is becoming every bit as important to product assembly as robots, riveters and nutrunners. That is borne out in our survey when we asked about specific “factory of the future” technologies. For example, 57 percent of plants are either currently employing technology for real-time and remote monitoring of the assembly line, or plan to within the next year. That’s up from 49 percent in 2020.

Similarly, 51 percent are using, or will soon use, tablet computers our smart phones on the assembly line; 33 percent are deploying Industrial Internet of Things technology; 32 percent are applying artificial intelligence or data analytics; and 22 percent are using smart watches, smart glasses and other “wearables.”

Forty-three percent of assemblers—a record high—report that material costs are a major concern for the coming year.

Other Technologies

Industry 4.0 initiatives might also be behind an increase in sales of marking, coding and automatic identification technology next year. Forty percent of plants will invest in laser markers, code scanners, radio frequency identification systems and other auto ID technology in 2022, up from 36 percent in 2021. Demand will be highest among assemblers of electronics, appliances, medical devices and consumer products.

In all, assemblers will spend $240.6 million in auto ID products next year, a 26 percent increase from 2021 spending.

Another technology that should see sales growth next year is dispensing and curing equipment. Thirty percent of assemblers will invest in meter-mix systems, LED curing lamps and other adhesive-related technology in 2022. That compares with 27 percent in 2021, and it’s only the second time in the past 10 years in which that ratio has exceeded 30 percent. Demand dispensing equipment will be above average in the electronics and medical device industries.

In all, spending on dispensing and curing equipment is projected at $199.4 million in 2022, up 4 percent from 2021.

Harness assembly shops are also looking to upgrade next year, perhaps in response to the rapidly growing market for electric and hybrid vehicles. Thirteen percent of assemblers will purchase wire processing technology in 2022, up from 9 percent in 2021. That may not seem like much, but it’s the highest percentage in 10 years.

All totaled, the market for wire cutting, stripping and crimping equipment will increase 28 percent, from $70.6 million in 2021 to $90.4 million in 2022.

Just 59 percent of assemblers—a record low—say that direct labor costs will be an issue next year. However, that could change if factories are forced to increase wages to attract workers.

Survey Methodology

ASSEMBLY magazine is sent to 35,001 assembly professionals, 93 percent of whom are in the U.S.

The survey was conducted in conjunction with Clear Seas Research, an affiliate of BNP Media, ASSEMBLY magazine’s parent company. Clear Seas is a full service, B-to-B market research company. Custom research products include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

Questionnaires were e-mailed in mid-August to a random sample of 20,077 subscribers in management positions. Forty-one percent of respondents were engineers; 54 percent were management; and 5 percent were classified as purchasing or “other.”

The cutoff date for returning the surveys was Sept. 5. Some 227 surveys were returned for a response rate of 1 percent.

The survey was sent to manufacturers in the following industries: aerospace, electronics, appliances, fabricated metal products, furniture, machinery, medical devices, plastics and rubber products, automotive, energy and miscellaneous manufacturing.

Geographically, 14 percent of respondents were located in the Northeast, 54 percent were in the Midwest, 20 percent were in the South, and 12 percent were in the West.

Sixteen percent of respondents had 25 employees or less. In addition, 19 percent had 26 to 100 employees, 15 percent had 101 to 250 employees, and 50 percent had more than 250 employees.

Twenty percent of respondents assemble products that can fit inside a 12-inch cube, 15 percent make products that can fit inside a 24-inch cube, 18 percent make products that fit inside a 36-inch cube, 30 percent make products that fit inside a 6-foot cube, and 16 percent make products that are larger than a 6-foot cube. The latter figure is below average for our survey, possibly because we received a below-average response rate from the automotive industry this year.

To purchase and download the entire capital spending report, please visit https://clearseasresearch.com. You can also email info@clearmarkettrends.com with any questions.

ASSEMBLY ONLINE

For more information on robotic assembly, visit www.assemblymag.com to read these articles: