Adhesives

Austin Weber // Senior Editor // webera@bnpmedia.com

Next-generation interiors demand adhesives that provide optical clarity, structural integrity and thermal interface.

New Technology for Bonding Automotive Displays

Automotive interiors today are influenced by smartphones, tablets and other types of consumer electronics. Illustration courtesy LG Corp.

Up until a few decades ago, instrument panels in most vehicles consisted of a smattering of simple analog buttons, dials, gauges, knobs and needles. Today, mechanical speedometers and tachometers have gone the way of bench seats, hood ornaments, hub caps and running boards.

They have been replaced with center stack screens and digital instrument clusters. Automotive displays have also become smarter. They don’t just offer touch capabilities; they provide haptic feedback and use cameras, sensors and other integrated devices.

Instrument clusters are traditionally located on the driver’s side, near the steering wheel. They display vital signs such as engine temperature, fuel level and vehicle speed. Center stack displays are flat-panel-based infotainment systems that offer a range of interactive features, such as cabin temperature controls, music and navigation.

New technology enables pillar-to-pillar displays that spread across interiors from one A-pillar to the other. Illustration courtesy Continental AG

“There’s a trend toward combining instrument clusters and center stacks into one large unit called a multidisplay module,” says Kyle Davis, senior analyst for connected car and vehicle experience at IHS Automotive. “Because it provides a cleaner look and feel in the interior, these types of displays are beginning to appear in vehicles such as the Cadillac Escalade and the Mercedes-Benz A-Class.

“Consumers today are used to interacting with displays on smartphones, tablets and other portable electronic devices, so automakers are following the trend,” explains Davis. “It’s a way for them to be creative and differentiate their products. We’re seeing more complex display configurations, because automakers are going for the ‘wow’ factor whenever someone steps into a vehicle.”

Growing Demand

New technology enables pillar-to-pillar displays that spread across interiors from one A-pillar to the other. Illustration courtesy Continental AG

According to Davis, by 2026, 47.4 percent of all new vehicles are expected to have a digital instrument cluster and 51.4 percent of center stack displays will measure 9 inches or larger.

“A display is the art piece that communicates the vehicle interior’s identity,” says Qais Sharif, vice president of the display product line at Visteon Corp. “Well-executed integration of technology in the cockpit can do a great deal to advance the public image of the vehicle.

“Large displays, multiple and complex displays, and optical bonding of complex display configurations bring the digital experience to the entire vehicle cockpit,” notes Sharif. “The digital cockpit is evolving into a multidisplay, interactive environment driving electronics complexity and cost. This poses new challenges and opportunities for product design and engineering”

Automakers and suppliers are combining instrument clusters and center stacks into one large unit called a multidisplay module. Illustration courtesy Visteon Corp.

To address the challenge, Visteon engineers are working with Corning Inc. to produce cutting-edge displays using Gorilla Glass parts that are thin and tough. They can be manufactured flat and bent at room temperature using Corning’s ColdForm technology. It enables automotive display applications that are either concave or convex. The same sheet can be bent multiple ways, from a C-shaped instrument cluster to an S-shaped center stack display.

Curved displays, head-up displays and organic light emitting diode (OLED) displays are starting to appear in some luxury cars. They feature higher resolutions and much larger sizes than what’s typically found in current displays. According to industry observers, the next step will be pillar-to-pillar displays that spread across interiors from one A-pillar to the other.

“The latest curved displays feature a radius of 1,000 millimeters, instead of the usual 3,000 millimeters,” explains Karl Bitzer, Ph.D., head of product management at DELO Industrial Adhesives. “This sounds technical, but this leads to closer viewing distances of the eyes to the display center and edges, enhancing the three-dimensional effect.

“Another trend is augmented reality head-up-displays that only need small installation space and offer stunning new features,” says Bitzer. “OLED displays [feature] deep black and brilliant colors. They also enable free-form, nonrectangular and slimmer displays behind the cover glass.”

This OLED display integrates two screens that are optically bonded behind a curved glass surface. Illustration courtesy Continental AG

Continental AG recently developed a large OLED display for a major OEM that it plans to begin producing next year. It stretches from the driver’s area to the center console and integrates two screens that are optically bonded behind a curved glass surface.

“The integrated OLED display ensures a first-class user experience and offers automotive manufacturers a further opportunity for differentiation and individualization,” notes Frank Rabe, Ph.D., head of the human-machine interface business unit at Continental. “Among other things, OLED technology delivers an aesthetically appealing user experience because it’s self-illuminating.

“This means that no backlighting is required, in contrast to conventional LCD displays, which results in extremely lightweight and flat units, and significantly increases design freedom thanks to the compact dimensions,” Rabe points out. “The technology also allows for more complex shapes and curved installation of the display. The screen’s slim bezel rounds off the overall visual package and creates a satisfying appearance.”

“Within only a couple of years, we will see the first displays on the market that blend with the décor,” adds Bitzer. “When inactive, they look like a decorative surface on the dashboard thanks to a partially transparent foil. When activated, the display backlights the foil.”

Big, Bold Displays

This 34-inch movable OLED display is designed for use in autonomous vehicles. Photo courtesy Hyundai Mobis

The new era of autonomous and electric mobility is allowing automotive engineers to start fresh and rethink cockpit designs with big, bold displays. It’s resulting in some jaw-dropping dashboards that feature unprecedented innovation of form factors, interface design and manufacturing techniques.

For instance, Hyundai Mobis recently turned heads when it unveiled a 34-inch movable OLED display concept designed for possible use in future autonomous vehicles. It features a curved screen that can swivel and move up or down. The display bends at three points from top to bottom.

However, three new vehicles that will be commercially available by the end of this year offer a glimpse of where automotive display technology is headed in the near future.

One vehicle that industry observers are keeping an eye on is the Cadillac Lyriq SUV, which will feature a massive 33-inch diagonal LED display. The large screen wraps toward the driver and information is intuitively displayed where it’s needed most.

The Cadillac Lyriq SUV features a 33-inch diagonal LED display. Photo courtesy General Motors

The 2023 BMW 3 Series sedan features a curved LCD screen. A 12.3-inch information display behind the steering wheel and a control display with a 14.9-inch diagonal screen merge together into a single fully digital, high-resolution unit. This cutting-edge cockpit design enables the number of buttons and controls to be significantly reduced in favor of touch and voice control.

A split-screen interface that previously separated the driver’s screen from the center console is now a single piece of curved LCD screen. The hardware itself is a single piece that runs through half the dashboard, starting from behind the steering wheel.

Another innovative display that has generated a lot of buzz in the auto industry forms the centerpiece of the new Mercedes-Benz IQS sedan. The 55-inch “hyperscreen” consists of three seamlessly integrated OLED displays housing two 12.3-inch screens for the driver and passenger, and a bigger 17.4-inch screen for the infotainment system.

The 2023 3 Series sedan features a curved LCD screen. Photo courtesy BMW AG

“The classic cockpit display with two circular instruments has been reinterpreted with a digital laser sword in a glass lens,” says Gorden Wagener, chief design officer at Daimler Group. “The large glass cover display is curved three-dimensionally in the molding process at temperatures of approximately 650 C. This process allows a distortion-free view of the display unit across the entire width of the vehicle, irrespective of the display cover radius.”

“The hyperscreen is an example of digital-analog design fusion,” claims Wagener. “Several displays appear to blend seamlessly, resulting in an impressive, curved screen band. Analog air vents are integrated into this large digital surface to connect the digital and physical world.

“The hyperscreen is surrounded by a continuous plastic front frame,” adds Wagener. “Its visible part is painted in an elaborate three-layer process in silver shadow. This coating system achieves a particularly high-quality surface impression due to extremely thin intermediate layers. The integrated ambient lighting installed in the lower part of the hyperscreen makes the display unit appear to float on the instrument panel.”

More than 10 actuators beneath the touchscreen provide haptic feedback during operation. If a finger touches certain points on the screen, it triggers a tangible vibration in the cover plate. The curved glass itself consists of scratch-resistant aluminum silicate.

For safety, predetermined breaking points alongside the side outlet openings, as well as five holders, can yield in a targeted manner if a crash occurs thanks to their honeycomb structure.

Adhesives in Demand

The 55-inch hyperscreen in the Mercedes-Benz IQS sedan consists of three seamlessly integrated OLED displays. Photo courtesy Daimler Group

Next-generation interior designs are good news for adhesive suppliers, because they require a variety of materials that must be bonded and sealed. However, engineers have to account for factors such as heat dissipation of circuit boards and electronics, and the structural strength of display housings and dashboard structures. Optical bonding also presents challenges, such as outgassing.

“The sky is the limit when discussing the future of automotive display design,” claims Christian Koehling, Ph.D., vice president and head of automotive components Europe at Henkel Adhesive Technologies. “Demands from customers require continued advancement of housing designs to better use interior space, as well as accommodate larger and more responsive screens that deliver higher levels of control.

“To eliminate the use of traditional buttons and create state-of-the-art interior control systems, there is increasing need for advanced optical bonding, structural bonding and thermal management materials,” says Koehling.

State-of-the-art automotive displays use a variety of dissimilar materials, such as glass and polycarbonate plastics for display panels. Frames are made out of aluminum, magnesium and various types of plastics, including ABS and polypropylene.

New electric vehicles, such as the M-Byte SUV, feature big cockpit displays. Photo courtesy Byton

“For automotive displays, screws, riveting or welding are not an option,” notes DELO’s Bitzer. “For engineers, the question is whether tape or liquid adhesives make more sense in their applications.

“Both are tension-equalizing, which avoids unwanted optical effects on the display,” explains Bitzer. “While tapes offer immediate strength after joining and some other benefits, we see more advantages when using liquid adhesives. Less material is used, universal geometries become possible and component tolerances are compensated.

“As a rule of thumb, tapes have advantages for large and flat surfaces with rectangular geometries,” Bitzer points out. “[Liquid adhesives are typically better for] applications that have smaller bonding areas with complex or three-dimensional geometries, or require higher reliability and additional features, such as tightness.

“For the structural bonding of displays into housings, engineers prefer to use acrylates, urethanes or silane-modified polyurethanes,” says Bitzer. “All these adhesives basically feature good adhesion and high flexibility. Many of them additionally offer a glass transition temperature beyond the service temperature range of displays.”

The glass transition temperature is the point at which the state of all plastics change from a vitreous, rigid state to a more flexible state that is perceived as soft and deformable in technical use. Significant mechanical and physical property changes take place during this process.

“Given the high volume of displays that need to be produced, manufacturers also look for adhesives that enable fast and highly automated assemblies,” adds Bitzer.

Editor’s note: A Six Sigma Master Black Belt, Anthony Tarantino holds certifications in project management and production and inventory management. He is the author of the new book Smart Manufacturing, The Lean Six Sigma Way, published in May by Wiley & Son’s. He will also be presenting webinar on July 20, titled “How Smart Technologies are Supercharging Continuous Improvement Programs.” Register for free here.

Bonding Applications

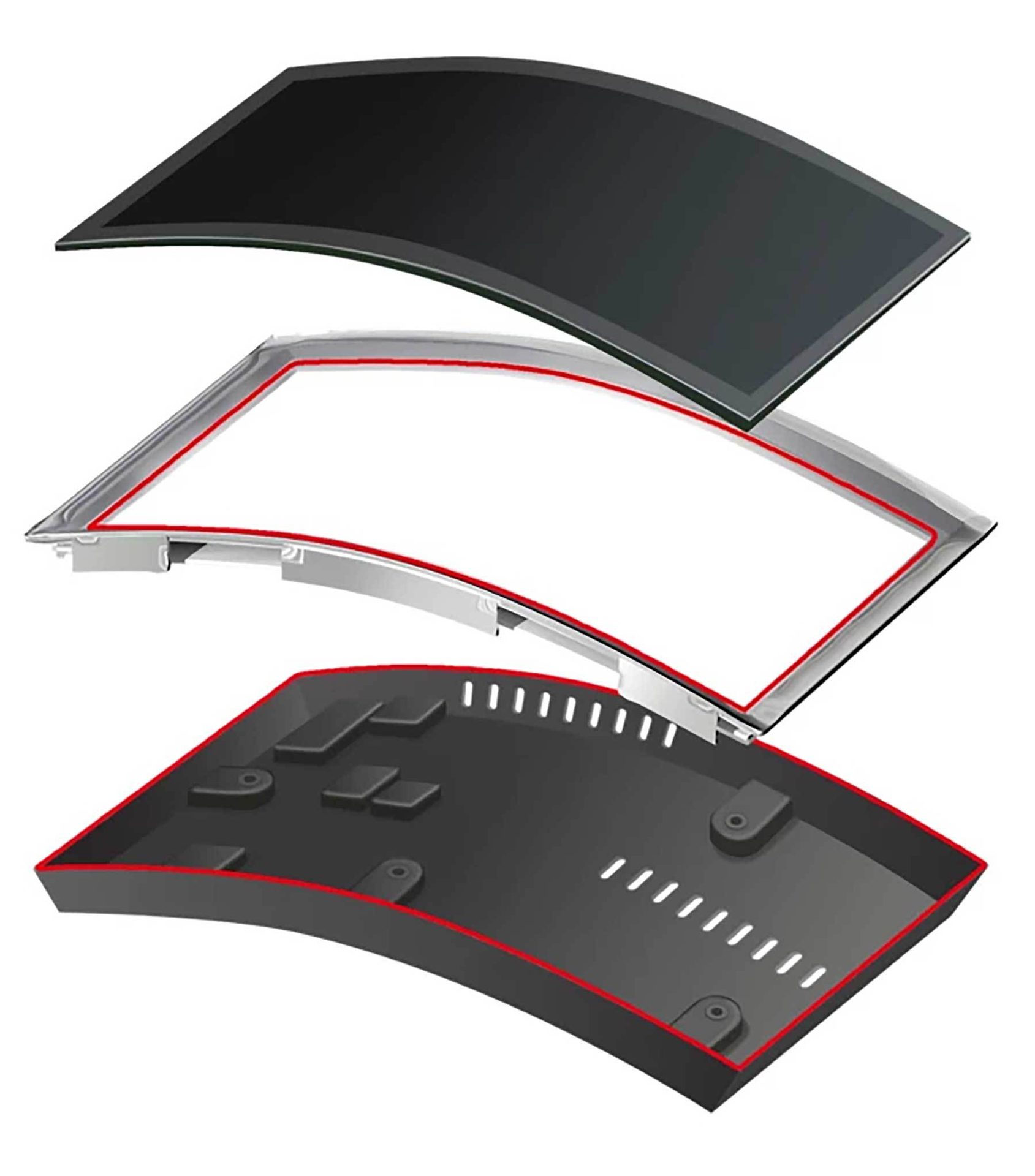

When integrating displays into assemblies, it’s important to create a tension-free and reliable connection between the display glass and the frame. Illustration courtesy DELO Industrial Adhesives

Navigation, infotainment and input screens, as well as head-up displays, consist of different assemblies that must be permanently connected to each other. Various adhesives can be used to structurally bond display frames to protective glass, to bond and seal displays in housings, and to conect functional components for haptic feedback.

Structural bonding is required to attach display modules onto dashboard frames or housing structures. However, challenges include bonding narrow borders and thin bondlines, quick handling strength and the need to assemble multiple substrate materials. New applications demand modules that are thinner and lighter, in addition to the need to integrate increasingly complex advanced driver assistance and infotainment systems.

“When integrating displays into assemblies, the most important thing is to create a tension-free and reliable connection between the display glass and the frame, as well as between the different materials of retainers, housings and active components,” says Bitzer. “Something else to consider is the size of the assemblies, which often requires the use of room-temperature curing adhesives.”

DELO has developed a range of adhesives with optimum properties that allow for fast cure-on-demand production processes. For example, its Photobond products can be preactivated with light and then cured by humidity.

Thanks to the use of optical bonding, there is no visible boundary or gap between this instrument cluster and embedded information display. Illustration courtesy Continental AG

According to Bitzer, light-curing materials enable fixation and curing within seconds, after activation with UV light. “These products feature fast initial strength and mechanical properties that fulfill automotive reliability requirements,” he points out.

“Even opaque components can be bonded quickly and reliably with these products,” claims Bitzer. “Our liquid pressure-sensitive adhesives offer another way of bonding display frames. They combine the properties of industrial tapes with the ease and automated processing of liquid adhesives.

“Our newest product for automotive display applications is Photobond LA4878,” says Bitzer. “It’s a modified urethane polymer with a unique set of features, including fast initial strength, high bond line thickness, and high resistance to media and humidity.”

Henkel has developed a similar light-based product called SpeedCure that’s designed to minimize stress and heat to temperature-sensitive components within display modules.

“SpeedCure is a versatile process that can be applied to multiple substrates, such as glass and aluminum or plastic frames and housing structures, for different designs such as curved and free-formed [displays],” notes Koehling.

Structural bonding is required to attach display modules onto dashboard frames or housing structures. Illustration courtesy Henkel Adhesive Technologies

A variety of acrylics, epoxies and silicones are used for optical bonding applications, which enable large displays and sensitive touch screen features that provide higher levels of control for interior systems. Optical bonding is performed with a combination of coating and lamination processes where critical optical performance is needed for the display.

The two main types of optical bonding materials are optically clear tape adhesive and liquid optically clear resin. The latter provides numerous benefits for flexible display designs, such as faster cure speeds and higher optical performance.

Henkel has developed liquid optically clear adhesives, such as Loctite DSP 3192 and DSP 3195DM, that enable optical bonding of various display designs and applications, inlcuding the joining of different substrates such as plastic to plastic, plastic to glass and glass to glass.

Koehling claims that improved display performance is evident in a 400 percent better contrast ratio in sunlight, a three times higher impact resistance, lower energy consumption, improved durability to heat, and superior impact load absorption, which enables thinner and more flexible designs.

ASSEMBLY ONLINE

For more information on adhesive bonding, visit www.assemblymag.com to read these articles: