FOCUS ON AEM

Battery recycling will become increasingly important as electric vehicles become more ubiquitous. Photo courtesy Volkswagen AG

Charging Ahead: Battery Recycling Gains Momentum

Before EVs can be widely mass produced, engineers must solve a variety of circular economy challenges.

As the automotive industry accelerates its shift toward electric vehicles, there is an increasing focus on battery recycling to address environmental concerns. By reclaiming materials from old lithium-ion batteries or manufacturing scrap, recyclers can contribute to a circular economy, repurposing resources and mitigating environmental impact.

This approach not only aligns with sustainability goals, but also presents economic opportunities if undertaken at scale. Global EV battery recycling capacity is on the rise, with numerous automotive and recycling companies forging partnerships and investing in recycling facilities.

For instance, Ford Motor Co. is working with Redwood Materials Inc., while General Motors has formed a strategic partnership with Lithion Technologies. Meanwhile, Stellantis has an alliance with Orano, and Toyota Motor North America is collaborating with both Cirba Solutions and Redwood Materials.

"The primary driving force behind the recycling market, at least in the European Union (EU), is legislation and regulation mandating manufacturers to recycle batteries or engage third-party recycling companies," says Pedro Pacheco, vice president of research at Gartner Inc.

This dynamic is expected to continue in the future, especially as the demand for raw materials critical for batteries rises, leading to increased costs. It will force automakers and battery suppliers to develop new recycling techniques and reuse applications.

Nathan Eddy // Contributing Writer

AEM PRODUCTS

"As material prices surge, manufacturers may shift toward recycling as a more cost-effective alternative to producing batteries from raw materials," explains Pacheco.

Despite the EU's regulatory moves, it is EV powerhouse China that leads the pack in battery recycling. According to the Boston Consulting Group, it boasts a recycling capacity exceeding half a million metric tons annually, followed by the United States and Europe.

Forecasts indicate significant growth in the battery recycling market, highlighting its potential as a lucrative sector in the coming years. In fact, a recent report from Technavio predicts it will expand into a $9.2 billion market by 2027, growing 11 percent annually.

In the United States, the Inflation Reduction Act is likely to accelerate efforts in battery recycling, as the legislation includes mechanisms to incentivize EV manufacturers and consumers to purchase vehicles that source battery metals from domestic manufacturers. Currently, the U.S. relies heavily on imported metals to meet the demands of battery production, with only a small fraction being domestically manufactured.

"This reliance poses a significant security risk, as any disruption in the global supply chain, such as during the COVID-19 lockdowns, could paralyze the operations of factories across the country due to a lack of access to essential materials," says Ryan Melsert, CEO of the American Battery Technology Co. (ABTC).

The AGV provides 50-course 128-command control, programming. The AGV is a model HA-A50060 single-direction AGV drive unit with 90° and 180° spin/turn capability. The unit can travel with speeds up to 164 fpm (50 M)/min and can carry a load capacity of up to 1320 lb.

Creform Corporation

800.839.8823

SCsales@creform.com

www.creform.com

AGV system with powered conveyor help increase productivity.

"Additionally, recycled metals can often be produced at lower costs compared to sourcing from primary mines," claims Melsert. "Recycling also carries a significantly lower environmental footprint than traditional mining methods, making it a more sustainable option."

Value Chains and Material Recovery

The battery recycling value chain encompasses four key stages: collection, discharge, shredding and materials recovery. While each presents distinct challenges and profit potentials, the highest profitability lies in materials recovery. However, this stage requires substantial capital investment and specialized expertise.

"While there isn't a one-size-fits-all method, a typical process might involve several steps," says Thomas Schmaltz, Ph.D., senior scientist at the Fraunhofer Institute for Systems and Innovation Research.

After batteries are collected, evaluated and sorted, they’re discharged to eliminate any remaining charge. Then comes the tricky task of dismantling the battery, often requiring manual labor, due to variations in battery designs and assembly processes. For instance some battery packs are screwed into chassis while others are welded.

The BalTec ELECTRIC EA30 is a roller forming machine with 3-axis servo technology. With its three-inline servo motors, the EA30 can control with precision the stroke and rotation of the roller head assembly plus articulation of the roller wheels. Each axis is individually programmable, offering superior forming capability and flexibility.

BalTec Corporation

724-873-5757

Articulating Roller Forming Machine with 3-Axis Servo Technology

Different types of batteries, can also have unique configurations and construction methods, a variability which makes it difficult to develop standardized dismantling processes. In addition, some batteries may contain hazardous materials or may be structurally challenging to take apart safely, requiring specialized equipment and handling procedures.

"Automating this step is a significant challenge that's driving substantial research and development efforts," Schmaltz points out.

Once disassembled, the modules or cells are extracted, depending on the battery's configuration.

According to Schmaltz, navigating the battery recycling landscape involves addressing several challenges and uncertainties. "The evolution of cell technologies poses a threat to existing recycling methodologies, which will require adaptability among recyclers," he explains.

Shredding, the most common next step in the battery recycling process, breaks down batteries into various components, generating streams such as "black mass," copper and aluminum foils, separators and electrolytes. The black mass constitutes a granular mixture of shredded cathodes and anodes, containing valuable metals like cobalt, nickel and lithium.

After shredding, the recovered materials undergo further processing to extract and purify metals through either heat-based smelting (pyrometallurgy) or liquid-based leaching (hydrometallurgy).

Pyrometallurgy, a high-temperature processing technique commonly used in the mining industry, has been repurposed for lithium-ion battery recycling. By roasting batteries in a furnace at temperatures reaching up to 2,550 F, valuable metals like cobalt, nickel and copper can be extracted.

However, this method comes with significant environmental drawbacks, including high energy consumption, hazardous emissions, and the destruction of graphite and binders within batteries.

Hydrometallurgy uses acids or solvents to leach metals from spent batteries. Although it boasts lower energy consumption, it generates sulfate waste and is less efficient at recovering certain metals like lithium.

Redwood Materials is working with Ford and Toyota to recycle lithium-ion batteries. Photo courtesy Redwood Materials Inc.

Reducing Waste, Maximizing Recovery

An innovative approach called electro-hydrometallurgy combines hydrometallurgy and electrochemistry to recover metals. By applying an electric current to a metal-containing solution, pure metals can be extracted and reused with less energy consumption and waste generation than traditional methods.

Direct cathode recycling focuses on recycling cathode materials directly into new batteries without intermediate metal extraction. Despite its potential, this approach requires precise separation of cathode materials and tailored processes for different battery chemistries, making it less universal than other recycling methods.

"When recycling batteries, you have other stuff like cooling fluids and cabling or electric circuit boards to deal with, and the main focus is on getting those metals out of the cells," says Pacheco. "As you aim for higher recycling percentages, say close to 100 percent, things get a bit trickier."

“Precision becomes crucial, because you need to separate out different metals and materials to ensure they can be reused effectively in new batteries,” warns Pacheco. "While there's growing interest from manufacturers, especially with rising raw material costs, it's still not quite hitting the mark financially for them to recycle at such high rates."

In Europe, Hydrovolt operates a large EV battery recycling plant in Fredrikstad, Norway. The company's annual capacity is 12,000 tons of battery packs, equal to approximately 23,000 moderately sized EV batteries.

"Our role is to ensure that no battery is ever wasted by developing...rocesses that enable us to recycle the materials in batteries over and over again, in which secures critical raw materials to reenter the manufacturing processes for green products," says Helge Refsum, chief technology officer at Hydrovolt.

The company uses a dry recycling process for industrial batteries, which begins with a thorough diagnosis, where the health and condition of the batteries is assessed to ensure safe handling. Next, any remaining energy is extracted from the batteries through a discharging process, allowing Hydrovolt to capture and store usable energy for future use while preparing the batteries for recycling. Once discharged, technicians dismantle the battery packs down to the module level.

The dismantled modules are then fed into an automated industrial crushing system that breaks them down into various outputs, including black mass, aluminum and copper. After crushing, a sorting system separates the various fractions, organizing them into large bags containing the recycled materials. These materials are then ready to be sold to buyers, completing the recycling process.

Motion Index Drives offers a variety of high-speed cam indexing solutions such as our RTX350 rotary index table and high-speed precision link conveyor to improve the efficiency of Electronic Vehicle battery manufacturing with higher precision and shorter index times.

Motion Index Drives

877-978-1830

High Speed Rotary Indexing Devices for Battery Manufacturing

Circularity in the Battery Supply Chain

ABTC operates a lithium-ion battery recycling facility at the Tahoe Reno Industrial Center in McCarran, NV, close to Tesla’s gigafactory. The facility spans 137,000 square feet and boasts an initial production scale set at 20,000 metric tons of battery feedstock per year.

Last fall, ABTC announced a partnership with BASF to establish a regional, closed-loop recycling system for lithium-ion batteries in North America. BASF will manufacture cathode active materials at its facility in Battle Creek, MI, using recycled metals sourced from ABTC, including nickel, cobalt and lithium.

Traditionally, the battery metal supply chain has operated in a linear manner, beginning with primary metals like lithium being extracted from ores and brines in the ground. These metals are then refined by large chemical refining companies before being transformed into high-energy-density active cathode material.

Battery packs must be disassembled before the recycling process can begin Photo courtesy Volkswagen AG

The Pfeiffer Vacuum ASM 340 performs helium and hydrogen leak detection in vacuum and sniffer modes, providing accurate measurement and short test times due to its high pumping speed. High sensitivity, ultrafast response time and short recovery time are among the outstanding features of this compact multipurpose unit.

Pfeiffer Vacuum

1-800-248-8254

Fast, Sensitive, Reliable Leak Detection

After synthesis, these cathode materials are sold to battery cell manufacturers, who use them to produce batteries. Finally, the batteries are sold to EV automakers.

"We have developed a closed-loop battery recycling process aimed at extracting and refining critical materials from end-of-life batteries," says ABTC’s Melsert. "The foundation of our process lies in its streamlined design, which allows for rapid material processing within a short time."

The company designed the integrated battery recycling system based on a strategic demanufacturing approach. Unlike conventional methods involving high-temperature furnaces or brute force shredding, ABTC's process focuses on deconstruction to extract metals and recover materials from spent batteries.

By using an automated deconstruction process coupled with targeted hydrometallurgical techniques, the company dismantles battery packs into modules, cells and subcell components before sorting and separating them strategically.

When batteries arrive at the facility, they still retain their electrical charge, and the company can handle these fully charged assemblies right from the start. Once they're on the feed conveyor, human intervention becomes minimal as the system takes over, operating in a fully enclosed environment.

"Our automated processes kick in, efficiently separating cells from modules and further breaking down subcomponents," explains Melsert. "Within the batteries, we encounter a diverse array of materials, including powders, liquids, dissolved species, organics, metal foils, metal casings and plastics."

Using the automated systems, technicians methodically sort and separate each category, directing them along different pathways. Many of these materials can be promptly sold, contributing to the revenue stream.

In the subsequent hydrometallurgical selective leaching phase, the lithium intermediate is refined into a battery-grade lithium hydroxide product. The black mass intermediate material is also further refined, producing battery-grade nickel, cobalt, manganese and lithium hydroxide products.

"For the higher-value metals, we employ additional purification steps to ensure their quality meets industry standards," notes Melsert. "These purified metals are then reintegrated into the active battery material industry, completing the circular loop of our recycling process."

This recycling process enables ABTC to achieve numerous benefits, from waste reduction and conservation of natural resources to decreased air pollution, and higher material recovery rates.

Another benefit of the approach is mitigation of air and liquid pollutant emissions, while early separation of low-value materials ensures the high recovery and purity of valuable products.

The recycled metal products meet battery cathode specifications, enabling them to re-enter the supply chain in a closed-loop fashion.

"We work with a lot of automakers and right now they have a lot of contracting underway for their end-of-life battery volume over the next few years," says Melsert. "We're in negotiations with many of them right now.

“As we move forward, major automakers are increasingly seeking more sophisticated systems to enable the recovery of larger material volumes and the return of metals back into the battery supply chain," adds Melsert.

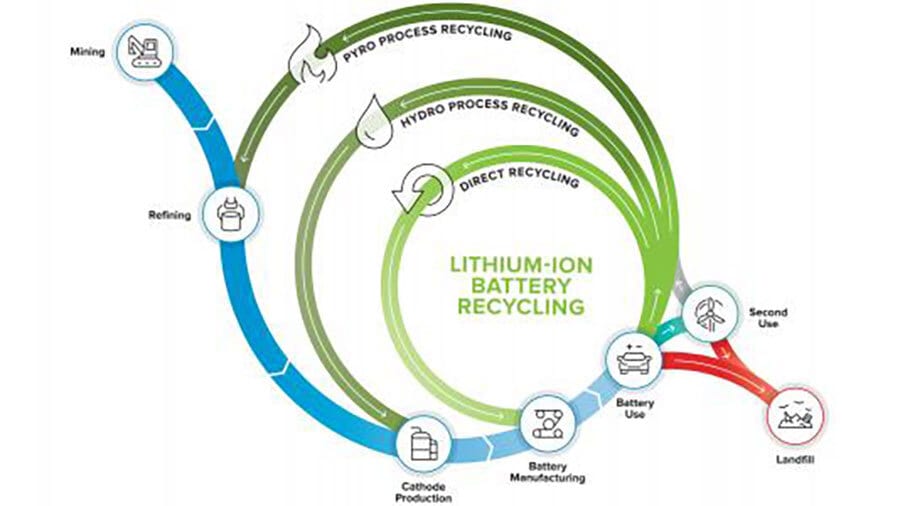

Closed-loop recycling initiatives will enable lithium-ion battery materials to be reused. Illustration courtesy Argonne National Laboratory

A Modular, Global Approach

RecycLiCo Battery Materials Inc. uses a hydrometallurgical process to recover up to 99 percent leach extraction of lithium, nickel, manganese and cobalt from cathode-active material, upcycling it into high purity, battery-ready materials such as lithium carbonate.

The company has progressed from R&D and pilot plants to a mini demonstration plant capable of processing up to 1,322 pounds of feedstock per day.

It recently embarked on a joint venture with Zenith Chemical Corp. called Recyclico Zenith Battery Materials Technology to process black mass. RecycLiCo is preparing a new plant in Vancouver, BC, that is scheduled to ramp up next year. The facility will be dedicated to processing and converting lithium-ion battery waste into resources including lithium-ion battery precursor cathode active material, lithium hydroxide monohydrate and lithium carbonate.

The company adopted a modular approach to its recycling facilities, building plants covering 8,000 to 9,000 square feet, which allows for flexible deployment directly to locations requiring battery recycling. The modular plant design enables on-site battery recycling.

"This way, we can minimize logistical challenges associated with building large factories and streamline operations for installation and commissioning," says Shaheem Ali, chief financial officer at RecycLiCo. "Because the plant designs are modular, you can expand as your capacity needs grow."

Recyclico's patented closed-loop hydromet process eliminates wastewater discharge, reduces energy and chemical consumption, and regenerates reagents used in the process.

"Filtration removes impurities from the black mass, while water usage is minimized by absorption into the product formation," explains Ali.

The method avoids sodium sulfate byproduct, which produces a more efficient and environmentally friendly recycling system with 62 percent less CO2 emissions than conventional recycling methods.

Recyclico validates its battery-grade cathode precursor or lithium carbonate-hydroxide products according to cell manufacturer specifications, ensuring they meet industry standards.

ZiMo enables easy and mobile positioning at various locations without the need for complex integration into existing systems. An intuitive setup allows for operation without programming knowledge and its flexible configuration with quick adaptation enables profitable automation solutions, even for small-batch sizes. ZiMo offers versatility and flexibility - thanks to its compact size and adaptable setup.

Zimmer Group US, Inc.

828-855-9722

info.us@zimmer-group.com

www.zimmer-group.com

Mobile Robotic Cell Provides Flexible Automation Solution

This validation process involves collaboration with manufacturers where the product undergoes evaluation and testing.

Sustainability at the Forefront

As battery manufacturing activity in the United States intensifies, recycling initiatives are expected to increase over the next decade. Unfortunately, the most eco-friendly battery designs are currently the least profitable to recycle. And, updates to battery designs may present future challenges for recyclers.

The batteries historically favored by EV manufacturers use expensive and supply-constrained critical materials, including cobalt, lithium and nickel.

Concerns about material availability, ethical sourcing and costs have prompted numerous automakers to transition to cobalt- and nickel-free lithium iron phosphate (LFP) batteries. As a result, LFP batteries increased from 6 percent of the lithium-ion battery market in 2020 to 27 percent in 2022, according to the International Energy Agency.

Robotics will play a key role in future battery recycling efforts. Photo courtesy Comau

The shift to LFP batteries may bring relief to the cobalt supply chain, but it also presents a challenge for battery recyclers, who target high-value critical materials for extraction. As a result, LFP batteries are currently less likely to be recycled, despite the increasing demand for graphite electrodes.

To address the issue, engineers at the National Renewable Energy Laboratory (NREL) and ACE Green Recycling, are developing new recycling techniques that will bridge the gap between sustainability and profitability, specifically for LFP batteries.

“Current hydrometallurgical recycling methods focus on extracting high-value materials from LFP batteries, such as lithium and copper,” says Andrew Colclasure, Ph.D., who leads NREL’s battery materials development and modeling research. “To encourage a more holistic approach to recycling, we must demonstrate efficient processes that also recycle low-value materials such as graphite and iron phosphate into commercially viable products.

“By focusing on graphite now, we hope to strengthen the energy materials supply chain and avoid future scarcity,” explains Colclasure. “To build a circular economy for electric vehicles, we must implement sustainable practices throughout the battery life cycle, and that includes recycling low-value materials.”

"We're in discussions with various OEMs to recycle scrap, aligning with their goals of achieving circularity in the supply chain," adds David Regan, vice president of Aqua Metals Inc. By 2030, he foresees increased opportunities to close the loop and integrate circularity into the battery supply chain.

Aqua Metals’ proprietary electrochemical process is designed to produce high-quality lead with minimal environmental impact. The process harnesses electricity to separate and extract valuable metals from batteries, bypassing the need for polluting furnaces or intensive chemical processes. Using a dilute acidic solution, AquaRefining applies electroplating to recover high-purity metals while ensuring the solution is regenerated for subsequent batches of recycled materials.

"Regenerative electro-hydrometallurgy is a sustainable approach to recycling lithium-ion batteries by continuously reusing and recovering materials," explains Regan. "In essence, regenerative electro-hydrometallurgy combines electricity and water-based solutions to promote circular economy principles and minimize waste in battery recycling.”

TorqTec offers a complete line of DuPas torque control power assembly tools: • Cordless Battery Pistol Hydraulic Pulse • Geared Special Attachment Hydraulic Pulse • In Line Pulse • Pistol Pulse • Right Angle Pulse • In Line Screwdrivers • Pistol Grip Screwdrivers (Pneumatic & Cordless) • Right Angle Screwdrivers (Pneumatic & Cordless) • Error Proofing / Poke Options • Traceability Capabilities

TORQTEC

919-561-5536

DuPas Torque Control Power Assembly Tools

A "closed loop" system means the company captures and reuses all the materials and chemicals used in the recycling process instead of just tossing them out.

"This not only cuts down on waste by as much as 95 percent compared to typical methods, but also helps minimize our environmental footprint," claims Regan. "We're also cutting recurring expenses and emissions by not shipping trainloads of chemicals back and forth or constantly buying new stuff."

Aqua Metals began the move toward sustainable battery recycling in late 2022 when it started commissioning its first facility at the Innovation Center in Nevada's "Lithium Loop.” The company is currently equipping Phase 1 of its Sierra ARC facility in Reno, with the aim generating critical battery minerals for around 30,000 average-sized EV battery packs.

Through a partnership with 6K Energy, Aqua Metals is suppling recycled battery materials from the Sierra facility for production of cathode active material at 6K's PlusCAM facility in Jackson, TN. The goal is to provide 30 percent of the nickel and lithium carbonate required for its facility.

"We feel we have the most viable long term solution to lithium ion battery recycling, and we're going to need it, because we're going to be producing millions of tons of lithium ion batteries and we need to recoup those high value materials in the coming decades," says Regan.

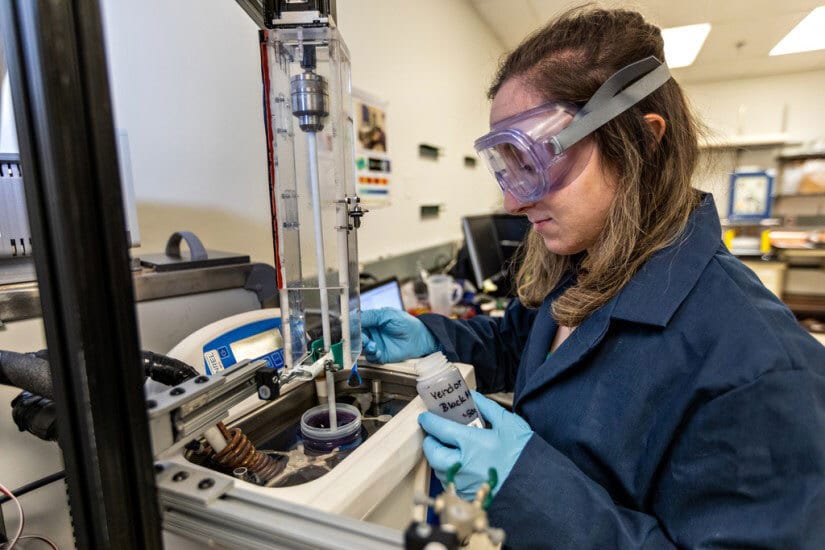

Recycling research aims to address sustainability challenges throughout the lithium-ion battery life cycle. Photo courtesy National Renewable Energy Laboratory

The Promise of Automation

Companies such as Hydrovolt operate automated collection and sorting facility, while the dismantling and disposal process is mostly manual. However, that’s expected to change in the near future as more battery recycling firms invest in robotics.

"Scaling up these technologies hasn't been widespread, because when the volume isn't there, robots might not be necessary,” says Gartner’s Pacheco. “But, for mass production, they're essential,”

However, each battery has its own quirks, which makes automation trickier to implement, especially in the dismantling phase, which is arguably the toughest part to automate.

"Take Tesla, for example,” Pacheco points out. “It uses foam to cover the cells inside batteries, which makes dismantling more challenging compared to other manufacturers. While reducing components can cut costs, it also makes recycling harder and costlier."

But, once lithium-ion battery components have been separated, automation becomes much more feasible. Many manufacturers are increasingly focusing on improving battery design with recycling in mind, striking a balance between simplicity and recyclability.

The large variability of different battery types, combined with wear and tear after years of service on the road, makes automating the recycling process particularly challenging compared to automation that’s deployed in assembly lines.

Hydrovolt plans to use robotics to help facilitate parts of the dismantling and discharging steps.

The company is also investing in automated guided vehicles to move heavy battery packs around its recycling facility.

Battery dismantling has traditionally been a manual process. Photo courtesy Ecobat

An Evolving Process

Lithium value will play a big part in whether some recycling initiatives are economically viable. For instance, it's the only valuable material in an LFP battery.

Some recyclers, such as Aqua Metals, plan to harness automation and artificial intelligence to streamline processes and ramp up productivity.

"We're really homing in on automation, aiming to make the whole process fully automated," says Regan. "Efficiency is the name of the game, and we've got a lot to learn and plenty of room for improvement--that's how we're going to boost our margins.

"Other chemistries, such as solid-state or sodium-ion batteries, might have a future, but they're decades away," says Regan. "The current chemistries are pretty baked in and if [battery suppliers are] spending billions of dollars building cell manufacturing in the U.S., they're not going to tear it out [anytime soon] and replace it with a different kind of [production process].”

According to Regan, if there's valuable material in the batteries, there's an economic case for recycling. Ensuring the recycling process doesn't contribute to the carbon emissions challenge is what's key to long-term success.

In the future, automation will enable battery recycling to be faster, safer and more efficient. Photo courtesy Fraunhofer Institute for Silicate Research

"These batteries are going to be used in grid storage and data centers and everything else," notes Regan. "We're committed to making sure the recycling infrastructure for the lithium-ion battery industry is green."

From Refsum's perspective, the processes for battery recycling are evolving at a rapid pace--both in terms of double-digit annual growth, and a constant development of battery types, chemistries, process technology and industry players.

"We expect these trends to continue over the next decade," says Hydrovolt’s Refsum. "I don’t think anyone has found the best way to recycle batteries yet. There are a lot of improvements to be done and technology to be developed."

The increasing number of EVs on the road strengthens the argument for why recycling will ensure sustainability and circularity in the battery value chain. New and upcoming regulations in Europe and North America will also help push the market toward widespread recycling.

Regulatory impact, including changes in waste management rules and export policies, could reshape the industry landscape, along with trends of moving away from per- and polyfluoroalkyl substances in lithium-ion batteries.

"It will [become] more evident that we need local production of these materials to help increase access to critical raw materials domestically," claims Refsum. He believes a dramatic scale up of the entire industry is needed, noting several companies are searching for the new ways of "direct recycling,” meaning that the recycled active materials of the batteries are not fully recovered back to the elemental materials, but reused directly in the manufacturing of new batteries.

Another important trend is cell-to-pack design, where the battery cells become part of the structural body of a car. These batteries will be more challenging to recycle.

This means future success in the battery recycling sector could hinge on the ability of companies to form closed-loop ecosystems and integrate capabilities across the value chain.

"Collaboration among stakeholders, including OEMs, battery manufacturers and recyclers, will be crucial," warns RecycLiCo’s Ali.

May 2024 | ASSEMBLYMAG.com